Insights

April 26, 2021

What You Need to Know About the New Washington State Long-Term Care Act

In Insurance, Tax Planning, Wealth Strategy

Update as of: January 27, 2022

On January 27th, Governor Jay Inslee signed House Bill 1732 which delays implementation of the long-term care payroll tax in Washington State for 18 months. Employers will not be required to collect the .58% payroll tax until July 1, 2023.

In addition, the law was updated so individuals born before January 1, 1968, who have not paid premiums for the required minimum of 10 years will be eligible for partial benefits. For every year premiums are paid, they will receive 1/10th of the full benefit or $3,650. Benefits for all participants in the program, even partial benefits, will not be available until July 1, 2026.

House Bill 1732 does not allow for an additional opt-out period and any taxes that were collected by employers at the start of 2022 must be returned to employees within 120 days.

Update as of: January 10, 2022

In mid-December Governor Jay Inslee announced he is temporarily halting the collection of the new Washington Cares Fund payroll tax while the state Legislature works to overhaul the legislation. Subsequently, the Governor clarified his remarks stating that he does not have the legal authority to overturn the legislation that created the payroll tax or excuse employers from withholding the .58% tax from employees starting January 1, 2022. As we wait for possible action by the Legislature, Governor Inslee has ordered the Employment Security Department to temporarily postpone the collection of the payroll tax from employers until April 2022, or until the Legislature gives further direction.

While we don’t know what revisions the Legislature might make during the Legislative session which began January 10th, if you have a long-term care insurance policy in place and have opted out of the Washington Cares Fund, we suggest you keep those insurance policies in place as we wait for more clarity from the Washington State Legislature on any changes they intend to make to the program.

Original Post: April 26, 2021

Washington State has passed a new law mandating public long-term care (LTC) benefits for Washington residents. The Long-Term Care Act was created to reduce pressure on the Medicaid system and will be paid for by a 0.58% tax on employee wages. While this program may be appropriate for many Washington State residents, such as those with average income and/or health conditions that prohibit obtaining private coverage, it may not be advantageous for you based on your individual situation.

Under current law, you have one opportunity to opt out of this tax by having a long-term care insurance (LTCi) policy in place by November 1st, 2021.

WHAT IS THE TAX?

Beginning January 1st, 2022, Washington residents will fund the program via a payroll tax. This tax is permanent and applies to all residents, even if your employer is located outside of the state.

The tax is currently set at $0.58 per $100 of payroll. This means for every $1,000 you make in 2022 and beyond, you will have $5.80 deducted to pay for this new benefit.

IS THERE A CAP ON THE AMOUNT OF WAGES THAT ARE TAXED?

Of significance, and unlike other state insurance programs, there is no cap on wages. All wages and remuneration, including stock-based compensation, bonuses, paid time off, and severance pay, are all subject to the tax.

WHAT IS THE BENEFIT?

Once vested, you will be eligible to access $100 a day, up to a maximum lifetime benefit of $36,500 (adjusted for inflation) to pay for expenses associated with needing assistance with activities of daily living (ADLs). Unlike private insurance that only requires you to be unable to do 2 ADLs, the State Plan requires that individuals need assistance with 3 ADLs. Examples of ADLs are dressing, bathing, cognitive impairment, and other basic functions of your daily routine.

WHO IS ELIGIBLE TO RECEIVE THE BENEFIT?

Washington State employees who have met the hour and minimum year requirements set by the state are eligible for benefits1. Those that do not pay into the program for a minimum of 10 years and those already currently retired will not be eligible for the state-run long-term care program benefits.

In addition, benefits are not payable until January 2025 and are not portable or payable if you reside outside of Washington state when you need benefits.

ARE SELF-EMPLOYED INDIVIDUALS EXEMPT?

Yes, self-employed individuals are exempt from the program but may choose to opt in. Under the program, self-employed individuals must elect coverage by January 1st, 2025, or within 3 years of becoming self-employed for the first time. If a self-employed person does not apply for the exemption now and later returns to work as a W-2 employee, they will be subject to the LTC tax.

WHO MIGHT WANT TO OPT OUT?

- Higher income employees who could purchase a more robust LTCi policy for less premium than the payroll tax.

- Employees who are newer to the workforce and would thus pay into the fund for decades, ultimately paying more in tax than they would receive in benefit.

- Employees who plan on retiring before the benefits are available.

- Employees who plan on retiring outside the state of Washington or want the flexibility to do so.

- Self-employed individuals who are considering returning to work for another company where they would be a W-2 employee, and therefore, subject to the tax.

It is important to remember that the new payroll tax is only paid while you are working. Traditional LTCi policy premiums are typically paid throughout your lifetime, although there are other options available where you could pay over shorter periods of time or in a lump sum amount. LTCi policies offer more comprehensive coverage then the state-run program and are portable to whatever state you reside in.

It is critical to note that while the payroll tax is currently set at 0.58%, there is no guarantee that the state will not raise this rate in the future. Purchasing a long-term care policy can protect you from potential future state tax rate increases, as well as protects future wage growth from the long-term care payroll tax.

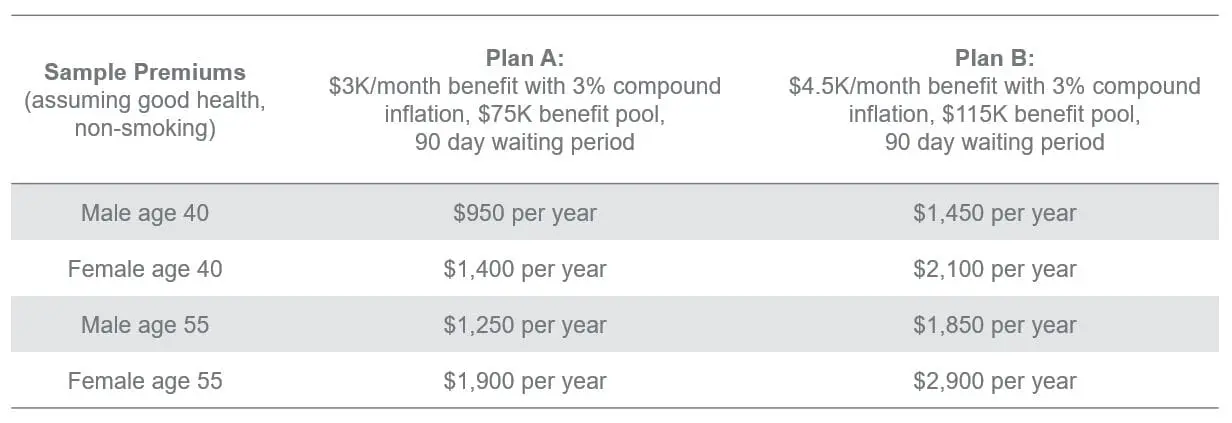

WHAT WOULD AN INDIVIDUAL LTC POLICY COST?

Premiums for LTC policies depend on the benefits selected, your age, and your health. Premiums are typically paid annually, and you can discontinue at any time. There is a risk that premiums will increase over time for traditional LTCi policies, as LTCi companies often do not guarantee level premiums. Note that individuals younger than 30 are typically not eligible to purchase traditional long-term care policies, and most companies do not issue policies to those over age 75.

LTCi coverage generally costs more for women than for men. That is because women file two-thirds of all LTCi claims, because they typically live longer than men. Many women also provide care for their husbands, reducing claims from men. Long-term care policy discounts may be available for those who are married and apply for joint coverage with their spouse.

Obtaining LTCi coverage typically requires a telephone interview to assess an applicant’s memory, plus a review of their medical history for pre-existing conditions that could require long-term care. Coverage is not available to patients who have had a stroke, Alzheimer’s disease, or certain other health issues.

WHAT COULD LONG-TERM CARE COST WHEN YOU NEED ASSISTANCE?

According to the 2020 Genworth Cost of Care survey for Washington State2, the average long-term care claim lasts for 2.5 years. The average cost per month in Washington is $11,954 for nursing home care (in a private room), $6,750 for assisted living, and $6,670 for home health care.

ARE THERE OTHER OPTIONS TO CONSIDER?

Yes, if you have an existing whole life insurance policy, you may be able to add a Long-Term Care Rider to that policy. This approach could be solution for a younger employee under 30 who would not be eligible to apply for a traditional LTCi policy.

There are additional insurance options available to you, such as utilizing a life insurance policy with added benefits for long-term care if you ever need them. These include hybrid policies and single pay, asset-based policies that could provide better long-term care coverage for you and would be considered comparable to the state program, exempting you from the payroll tax.

HOW DO YOU APPLY TO OPT-OUT OF NEW LTC PAYROLL TAX?

Between October 1st, 2021 – December 31st, 2022, you will need to complete and file a waiver application with the state attesting that you have other long-term care insurance. Once you opt out, you cannot opt back into the program, i.e., the opt-out is permanent. You must provide a copy of the waiver certification to your current and all future employers, and employers must maintain a copy of this letter.

There is nothing currently in the program that prevents you from dropping your individual coverage at some point in the future after opting out of program; however, this loophole and potential lapsing policies is a major concern, so the state may decide to implement an annual certification process in the future.

WHAT ARE THE NEXT STEPS?

If you are considering opting out, please contact your Relationship Manager so we can evaluate your individual situation and options available to you. Note that most LTCi specialists are requesting applications be submitted by June to ensure policies can be put in place well in advance of the November deadline.

Thank you,

Your Coldstream Team

Sources

- a total of 10 years without a break of five or more years; or

- 3 years within the last 6 years from the date the application for benefits is made.

DISCLAIMER: THIS ARTICLE HAS BEEN PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE CONSIDERED AS INVESTMENT ADVICE OR AS A RECOMMENDATION. THIS MATERIAL PROVIDES GENERAL INFORMATION ONLY. COLDSTREAM DOES NOT OFFER LEGAL OR TAX ADVICE. ONLY PRIVATE LEGAL COUNSEL MAY RECOMMEND THE APPLICATION OF THIS GENERAL INFORMATION TO ANY PARTICULAR SITUATION OR PREPARE AN INSTRUMENT CHOSEN TO IMPLEMENT THE DESIGN DISCUSSED HEREIN.

Disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any federal tax advice contained in this communication (including attachments) is not intended or written to be used and cannot be used for (1) avoiding penalties imposed under the Internal Revenue Code or (2) promoting, marketing or recommending to another party any transaction or matter addressed herein unless the communication contains explicit language that it is a tax opinion in compliance with IRS requirements. Please contact your tax advisor for guidance on your individual situation.

Insights Tags

Related Articles

June 27, 2025

Diversified Estate Planning for LGBTQ+ Families

June 20, 2025

Incorporating a “Die with Zero” Philosophy into Your Long-Term Financial Plan

June 1, 2025

Maximizing Your Google Benefits: A Strategic Guide for 2025