Insights

July 15, 2022

Where From Here: A Recap of the Second Quarter and Thoughts Going Forward

In Market Commentary

Until mid-June, the Fed was widely perceived as behind the curve in fulfilling its mandate of price stability. For example, even though inflation was increasing in the first quarter, the Fed was still stimulating the economy by buying government securities and mortgages because of its mistaken view that inflation was transitory. In May, inflation, as measured by the Consumer Price Index, rose to 8.6% its highest level since December 1981.

The Financial Markets’ Reaction to Inflation Until Mid-June

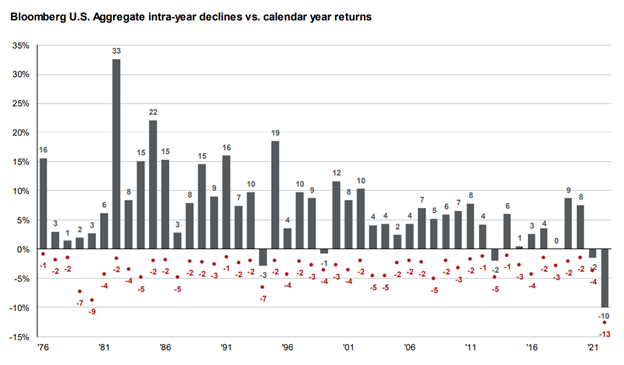

Concerns about inflation resulted in the US fixed income markets posting their largest decline, as measured by the Bloomberg Barclays US Aggregate Index, in 40 years.

Source: JPMorgan

Like fixed income, equities declined significantly with the S&P 500 falling into a bear market during the quarter, declining over 25% at its trough. Companies that investors perceived would fare poorly in an inflationary environment had larger stock price declines than the market as a whole.

Commodities, whose prices typically rise along with inflation, were the only major asset class to show positive performance in the second quarter.

The perception that the Fed was not acting aggressively enough to curb inflation changed in mid-June. At that time, the Fed raised the Fed Funds rate by 0.75%, the largest single increase since 1994, and, perhaps more importantly, clearly stated that it was committed to reducing inflation, implying it would risk an economic slowdown or even a recession, if necessary to accomplish this goal.

The Fed and Financial Markets Since Mid-June

Financial markets reacted to the Feds actions and pronouncements. Yields on US high-quality fixed income instruments fell, and the US equity markets came off their lows and closed slightly above bear market territory at the end of the quarter. Many of the growth companies that had large stock price declines rallied the most, although their stock prices are still substantially lower for the year.

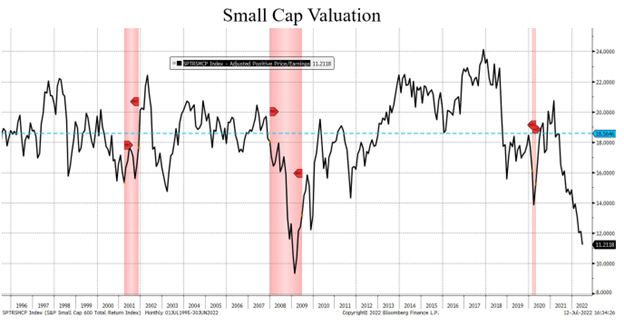

As a result of the sell off in equities, valuations in large cap US stocks appear reasonable, and US small-cap stocks’ valuations are the lowest since the Great Financial Crisis.

Source: Bloomberg

However, these valuations are based on forward earnings estimates, and, in many instances, analysts have not reduced earnings estimates despite potential margin pressure and the potential of a demand slowdown if consumers cut back on spending due to inflationary or other economic concerns. Over the next several weeks, companies will be reporting earnings and providing forward guidance on profitability, which could have a significant effect on the short-term direction of the US equity markets.

Where from Here

The Fed will attempt to curb inflation by raising the Fed funds rate to make borrowing more expensive and curtail demand. The Fed’s commitment to curbing inflation makes an economic slowdown highly likely and increases the chance that the US economy falls into a recession.

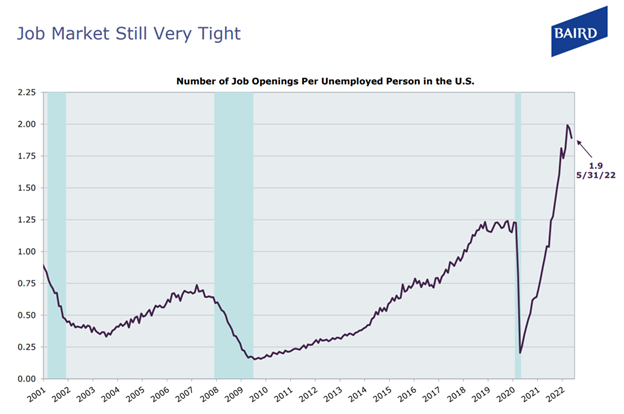

However, the difference between a slowing economy and a mild recession is simply one of degree and may not be economically significant. We would expect any recession that might occur to be mild as aspects of the US economy are currently strong. The US consumer is in relatively good financial condition with strong household balance sheets. Unemployment is at extremely low levels and job openings are greater than the available workers to fill those jobs.

Source: Baird

Certainly, a slow down or recession would impact these statistics, but there is nothing akin to the “bubbles” that existed in 2008 that would precipitate a deep recession and cause an economic unraveling.

What To Do

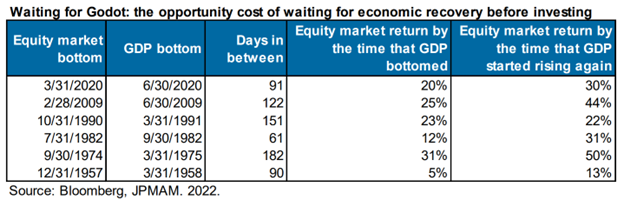

Historically, financial markets are a leading economic indicator and have begun to recover long before GDP bottoms. Those who have reduced equity exposure anticipating a recession have missed out on substantial returns.

This reaffirms our view that one should not try to time the market. Equity markets have already declined significantly this year and, in our view, locking in losses would be a mistake for the vast majority of our clients. Although we cannot predict whether there will be another leg down in the equity markets, any recession we might enter into should be relatively mild given the strength of many aspects of the US economy currently.

As to fixed income, if the economy does substantially slow or enter into a recession, investment grade fixed income should perform well as yields should fall on slowing growth prospects, which would result in higher prices.

Those of you who read these letters regularly know our mantra: stick to your financial plan. Over the long run, sticking to your financial plan and not deviating from it due to short-term market predictions is the best way to achieve your financial goals.

Related Articles

August 6, 2024

Q3 2024 ISG Webinar

July 25, 2024

Market Commentary: A Rally with Shifting Leadership

April 18, 2024

Market Commentary: Growth in the US vs. Other Advanced Economies & Thoughts on Israeli/Iranian Hostilities