Insights

April 18, 2024

Market Commentary: Growth in the US vs. Other Advanced Economies & Thoughts on Israeli/Iranian Hostilities

In Market Commentary

GDP grew at 3.4% in the fourth quarter of 2023 and is predicted to grow by over 2% in the first quarter of 2024. Driven by strong growth and continued optimism about the potential of Artificial Intelligence, the S&P 500 gained 10.56% for the quarter, the best quarterly performance since the first quarter of 2019.

In 2023, gains in the market-cap weighted S&P 500 were primarily driven by seven large cap tech stocks (the Magnificent Seven), but in the first quarter of this year, the equity market broadened out with the number of stocks showing positive performance significantly increasing. At the same time, performance among the Magnificent Seven diverged, with Nvidia outperforming Tesla by a whopping +111.71%

The Number of Advancing Stocks Minus the Number of Declining Stocks

Source: Bloomberg

The Magnificent Seven

Source: TradingView

Fixed income markets, on the other hand, declined for the quarter as inflation proved stickier than analysts expected, with February CPI showing a slight increase from January. Market participants reduced their projected pace of Fed rate cuts from six to three in 2024, with some speculation that there might not be any rate cuts this year. As a result, yields across the Treasury curve increased. For example, the yield on 10-year Treasuries went from 3.87% to 4.20% over the quarter and yields on 2- year Treasuries went from 4.25% to 4.62%.

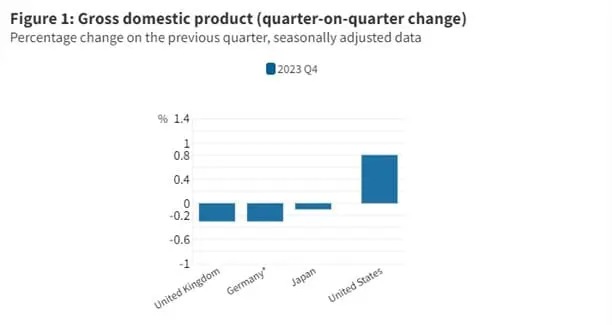

US Growth vs. Other Developed Market Countries

Like the Fed, most Advanced Economies’ Central Banks have raised their Fed Funds rate equivalent in an attempt to curtail inflation by slowing economic growth. So far, those economies have slowed, due in part, to those rate increases. The United Kingdom and Japan are in a technical recession (two consecutive quarters of negative GDP growth) and Germany’s GDP growth turning negative in the fourth quarter. However, unlike those other Advanced Economies, the US economy is experiencing steady growth.

Source: OECD (2024) Quarterly National Accounts (Database)

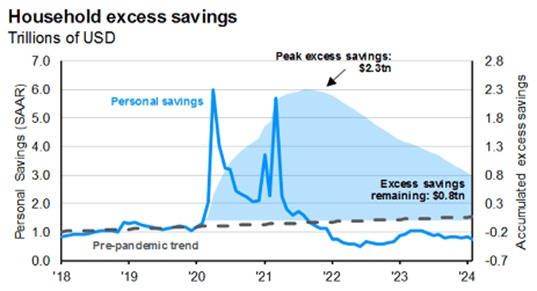

In our view, one major reason for the divergence in growth between the US and other Advanced Economies is that various forms of economic stimulus in the US have provided support for the US economy even as the Fed has tried to slow growth. As a percentage of GDP, the amount of COVID stimulus in the US far exceeded the stimulus provided by other Advanced Economies. According to the International Monetary Fund, COVID-related spending and tax breaks constituted 25% of US GDP. No other Advanced Economy approached that level.

As a result of this stimulus, households have a significant amount of excess savings supporting economic growth.

Source: JPMorgan

The Fed is trying to curb inflation and slow the economy by increasing the cost of borrowing. It is doing it in two ways: raising the Fed Funds rate and reducing its balance sheet by letting the bonds it owns mature and not replacing them.

The Fed also drained liquidity by borrowing money from banks and money market funds through a mechanism called reverse repo, which takes money out of circulation. While the Feds’ balance sheet reduction is draining liquidity, the usage of reverse repo is also shrinking (financial institutions are borrowing less), counter-acting the effect of the balance sheet shrinkage (see the difference between the blue and red bar in the middle column of the chart below).

Source: Strategas Research

Household savings from governmental stimulus is still providing the liquidity needed to grow the US economy, and the Feds balance sheet reduction has not drained that liquidity, resulting in continued growth in the US economy despite higher interest rates.

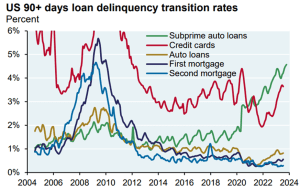

Currently, US households are spending their excess savings, and financial institutions have unwound most of their borrowing from the Fed. From a tailwind to economic growth, these factors could become a headwind, as consumers spend less, and financial institutions have less liquidity. Whether this curtails inflation or slows economic growth is unclear. We do know, however, that there are signs that higher interest rates are beginning to affect lower income households as credit card and sub-prime auto loan defaults and delinquencies are increasing.

Source: JPMorgan

Geopolitical Tensions

As I write this letter, Iran has attacked Israel in retaliation for Israel’s attack on Iran’s Syrian Consulate. It is not known what Israel’s response will be and whether the situation will escalate. Currently, any impact on financial markets has been muted. However, if the situation escalates, it will most probably have a short-term impact on both the equity and fixed income markets globally, but how the situation will evolve is unknowable.

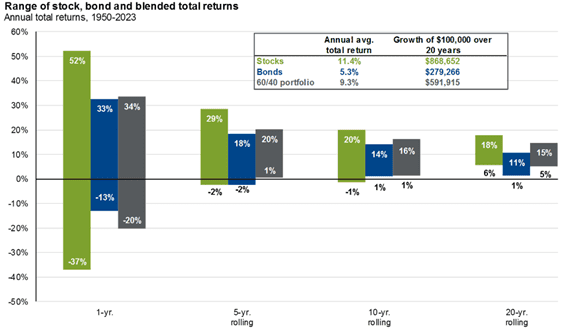

We strongly encourage clients to maintain a diversified portfolio despite the geopolitical uncertainty. Equity markets experience significant drawdowns even in years when equity markets are up substantially.

Source: JPMorgan

We may make small tactical moves in portfolios to reflect market opportunities, risks, or our geopolitical views but never at the expense of diversification. In the long run, diversification mutes volatility and creates the best opportunity for you to meet your financial goals.

Source: JPMorgan

We thank you again for our trust in us and are honored to work with you. If you have any additional questions or comments, please feel free to contact your Wealth Manager, your Portfolio Manager, or me.

Related Articles

July 11, 2025

The Return of Diversification

July 10, 2025

Watch Coldstream’s MarketCast for Third Quarter 2025

June 24, 2025

Managing Increased Uncertainty in the Middle East