Insights

January 20, 2022

Looking Past Covid

In Market Commentary

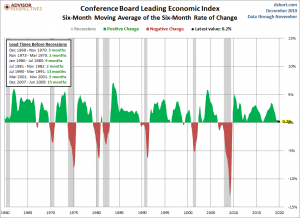

Until the onset of COVID-19, the US economy had been in a period of slow and steady growth and low inflation since the recovery from the 2008 Great Financial crisis. COVID-19 broke that cycle – after an initial and dramatic decline, the US economy and financial markets recovered quickly. This was due to massive governmental stimulus, which resulted in significantly higher growth in late 2020 and throughout 2021 than the economy had experienced in decades. Now, along with that growth, inflation has followed. Assuming the pandemic subsides in the near future, two key questions loom: (1) can inflation be brought under control without impairing growth, and (2) what will the removal of governmental stimulus mean for the economy and financial markets.

Where We are Now

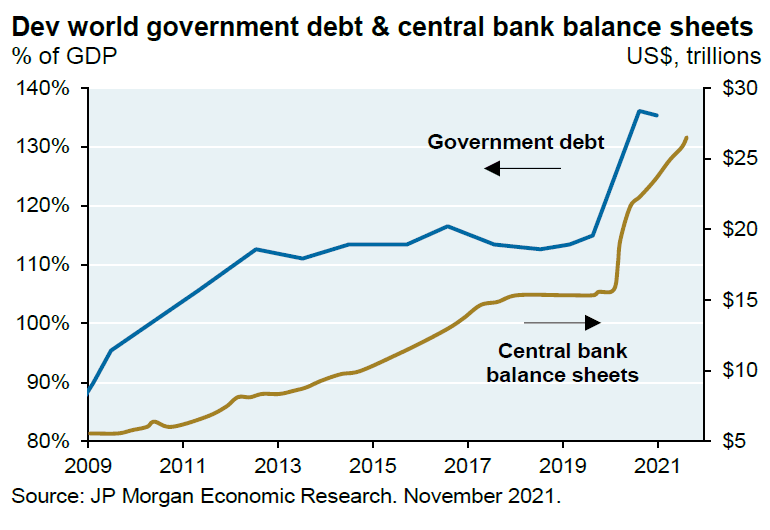

Over the last two years, more stimulus has been injected into the US and other developed world economies than at any time since World War II – far more than was used to recover from the Great Financial crisis.

This stimulus increased many consumers’ income to above pre-COVID levels and dramatically increased the personal savings rate. Corporate profitability in many industries soared as well. Although consumers dramatically curtailed their consumption of services (travel, hotels, restaurants), their spending on goods dramatically increased. This increased profitability and liquidity led to strong equity markets, with the S&P 500 rallying 112.61% from the lows of March 2020 through December 31, 2021.

However, the spending increase has also fueled inflation as the supply of goods has not kept up with consumer demand, resulting in higher prices.

In addition, the unemployment rate has recovered to pre-COVID levels, and job openings are abundant, yet the economy has lost about eight million workers. This worker shortage has caused wages to rise, creating additional inflationary pressures.

These inflationary pressures negatively impacted the fixed income market in 2021, with the Bloomberg-Barclays US Agg down -1.54%.

Inflation – Looking Ahead

The goods inflation caused by the demand/supply mismatch should eventually ease if COVID-19 also eases. Production facilities that have been shut down because of COVID outbreaks should come back to full production, and the US consumer’s demand for goods may well decrease. The excess savings that sparked the demand for goods are already declining. Furthermore, the government’s fiscal stimulus will be drastically reduced, regardless of whether Congress passes the “Build Back Better” bill, as almost all the Congressional programs that provided support to consumers in 2020 and 2021 will expire.

Source: Strategas

Wage inflation, however, appears to be a more significant concern for policymakers than goods inflation. One of the critical unknowns here is whether the eight million “missing workers” will return to the workforce, alleviating the current supply/demand imbalance for labor. There are numerous reasons that workers have left the work force, and some of these should resolve themselves: those that do not need to work temporarily because of savings will have to go back to work eventually; those concerned about COVID will go back when the pandemic eases further; those who cannot find child-care or are concerned about sending their children to child-care may be able to find it again. However, the other significant component of the “missing worker” phenomenon is less certain to be resolved; those who have taken early retirement. It is unclear whether their economic circumstances will force them back to work.

The Fed is expected to begin removing its monetary stimulus soon to combat inflation. The Fed lowered the Fed Funds rate to zero to combat the COVID-19 related economic shutdown in early 2020. Lower Fed Funds rates affected all other US interest rates and spurred lending, which fostered economic activity. As the economy is recovering and inflation has become elevated, the Fed has indicated it will begin raising the Fed Funds rate. In addition, the Fed began the outright purchase of bonds in 2020 to support the fixed income markets. The Fed has lowered the amount of bonds it is purchasing and will at some point stop its purchasing of bonds. This should also reduce the demand for bonds, which may also cause rates to rise.

Despite the economic headwinds of reduced fiscal and monetary stimulus, the US economy should, in our view, continue to grow, and corporate profitability is expected to remain relatively strong. However, those growth and profitability rates will not reach the extraordinary levels they reached in late 2020 and 2021, as those growth rates were measured against a shut-down economy.

In the longer term, many factors in the US economy may naturally limit inflation, including aging demographics in the US and other developed countries as well as China, and also the efficiencies created by technological advances. Thus, while bond yields have risen in 2022 and current inflation is higher than the US economy has experienced in decades, long-term inflation expectations are slightly above 2%.

Equity Markets – Looking Ahead

US equity market returns have been exceptionally strong over the past 10 years, averaging 16.61% per year. However, a significant portion of those returns have been the result of multiple (the amount an investor is willing to pay for a dollar of earnings) expansion. In fact, most of the excess performance of US equity markets over international equity markets has been due to that multiple expansion.

Last year, US equity markets had strong returns despite some multiple contraction due to excellent corporate profitability.

Despite last year’s multiple contraction, US large-cap stock valuations remain high by historical standards. While corporate profitability may well continue at a good pace and long-term inflation may be controlled, it is not unreasonable to think that multiple expansion will no longer be a significant driver of equity returns going forward given the multiple expansion the US equity markets experienced over the last decade.

As to fixed income markets, so long as the US economy does not experience run-away inflation, interest rates may well rise but could still stay relatively low by historical standards.

What does this mean?

For a diversified portfolio, one could anticipate more modest, but still positive, returns over the next decade.

Making big short-term bets on inflation or the direction of the stock or bond markets dramatically increases your risk of not meeting your long-term financial goals. Maintaining diversification and, perhaps, using small tactical shifts at times to take advantage of dislocations gives you a far greater chance of reaching them. As always, we thank you for your trust in us. If you have any questions, please feel free to contact your Relationship Manager, your Portfolio Manager, or me.

Sincerely,

Howard Coleman | Chief Investment Officer and General Counsel

Insights Tags

Related Articles

June 24, 2025

Managing Increased Uncertainty in the Middle East

June 4, 2025

Watch Coldstream’s Q2 2025 ISG Webinar

April 14, 2025

Watch Coldstream’s MarketCast for Second Quarter 2025