Insights

February 25, 2020

The Coronavirus and Markets

In Market Commentary

February 25, 2020

In the last several days, fears about the Coronavirus spreading have resulted in a “risk off” environment in financial markets: equity markets globally have lost value and US Treasury prices have risen. As of the time of this letter, on February 25th, the S&P 500 is down 7.2% from its peak, the MSCI Emerging Market Equity Index is down 8.00% from its recent high, and the yield on the 30-year US Treasury Bond is at an historic low of 1.79% (bond yields move in the opposite direction from price).

Even in years when the equity markets have had excellent returns, there typically have been periods during those years when the equity markets suffered a significant sell-off. And valuations in the US equity markets were stretched before this latest drawdown. Whether this drawdown is just a normal correction or signifies something more fundamental will depend on the impact the virus has on US and global growth. It is still too soon to make that determination with any meaningful degree of certainty.

However, as you can see from the fact that bonds rallied on Monday as the stock market fell (and our liquid alternative portfolio performed in between stocks and bonds), a diversified portfolio should mute equity losses during market sell-offs. As the effect of the virus on the global economy and corporate profitability becomes clearer, we may make tactical shifts in the portfolio, but will not abandon the principal of diversification.

So that you can get a better sense of how we are thinking about the virus in relation to markets, let’s review some facts about the virus, where we are in terms of the fundamentals of the US economy, and how this translates into your portfolio.

SOME FACTS ABOUT THE VIRUS

The market sell-off on Monday appears to be due to a meaningful number of new Coronavirus cases outside of China, most notably in Italy, South Korea, and Iran. In Italy, the virus has now killed nine people, and 50,000 people in the Lombardy region have been forbidden from leaving the area. The region affected in Italy is in the wealthy, industrial core of that country. As we know, this pales in comparison to the number of cases in Wuhan, China, and the number of people affected by the Chinese quarantine, which is in the tens of millions.

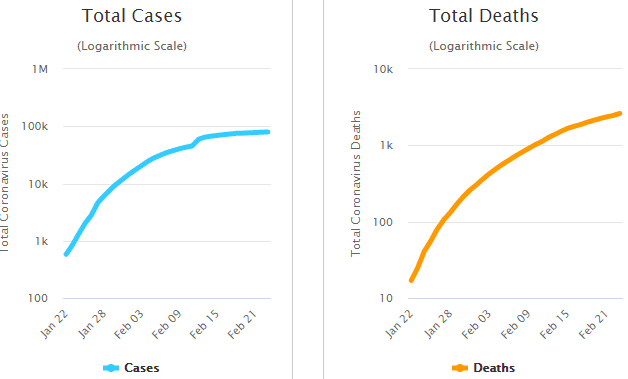

The Coronavirus appears to be extremely contagious but has not resulted in a high percentage of fatalities. There have been over 79,000 reported cases to date, resulting in 2,628 deaths. This is far less than the approximately 810,000 hospitalizations and 61,000 deaths from the seasonal influenza in the US alone during the 2017-2018 flu season, as estimated by the Centers for Disease Control and Prevention. Over 25,000 people have recovered from Coronavirus, and of the 51,000 remaining cases, 40,000 of them are considered mild.

While the number of cases continues to increase steadily, the rate of growth appears to be leveling off (although we cannot be certain of this, as these are in part based on numbers coming out of China that could well be inaccurate).

Source: Worldometer

ECONOMIC FUNDAMENTALS

In terms of the world economy, the reaction to the virus is as impactful as the virus itself. With factories in China shut down as a result of the virus, the disruptions to the global supply chain could be significant. We have heard anecdotal concerns from business owners and revised downward profitability estimates from corporations based on the availability of goods or parts for the upcoming 2020 holiday season. Certainly, other areas in the economy, such as travel, are already significantly affected. However, if the spread of the virus is contained or a vaccine is developed in the near future, any impact will be transitory. Thus, it would be speculative and unwise to draw any firm conclusions about the long-term economic effect of the virus at the current time.

PORTFOLIO POSITIONING

As we have discussed in the past, we follow a variety of metrics that track the US economy. Of these metrics, the Conference Board’s Leading Economic Index (LEI) has proved the most reliable in predicting recessions. We expect that the economic impact from the virus will be reflected in these indicators over the next several months.

We have seen the LEI decline over the last year and as a result we tilted portfolios to a slightly more conservative positioning in the fall, but still maintained significant equity exposure. Currently, the rate of growth in the LEI is close to zero, depending on the time frame for comparison. If this rate of change turns negative, we anticipate making another incremental, conservative change to portfolio positioning. These changes will be not be drastic and will be consistent with the broad principal of diversification.

We are cognizant of not reacting emotionally to the news of the day. In other periods of equity drawdowns over the last several years, sell-offs often have been related to extraneous issues and did not concern long-term economic fundamentals and, at times, we viewed them as good opportunities to put cash to work. The Coronavirus is potentially different from these other recent drawdowns if its impact on global manufacturing, tourism, and trade continues to grow, which would meaningfully affect economic fundamentals. We continue to closely monitor the data and will respond accordingly.

If you have any further questions, please feel free to contact me, your Relationship Manager, or your Portfolio Manager.

Sincerely,

Howard Coleman

Chief Investment Officer and General Counsel

Insights Tags

Related Articles

July 11, 2025

The Return of Diversification

July 10, 2025

Watch Coldstream’s MarketCast for Third Quarter 2025

June 24, 2025

Managing Increased Uncertainty in the Middle East