Insights

February 18, 2025

Accessing Your Tax Documents

In Tax Planning

It’s that time of year to begin collecting documents in order to prepare your tax return. The good news is that the process is becoming ever easier and more streamlined. You can download our one-page guide on accessing your tax documents here, or read on below for instructions on navigating the Fidelity and Schwab websites to collect your forms.

Documents are usually available in early to mid-February. Be sure to check back periodically if your documents are not immediately available.

- Mobile access: Both Fidelity and Schwab have mobile apps that also allow you to access and download your tax documents. You can download the apps from the app stores on both Apple (iOS) or Google Play (Android).

- Paper vs. electronic delivery: You can opt to receive paper tax documents via mail. However, electronic delivery is faster and more convenient for most. You can update your preferences in the account settings on either platform to receive documents.

Fidelity

- Log in to your Fidelity account.

- Open a web browser and go to the Fidelity website: fidelity.com

- Click on the “Log In” button at the top right corner of the page.

- Enter your username and password, then click, “Log In.”

- Navigate to your tax documents.

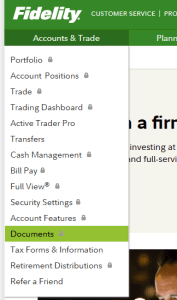

- Hover over or click on the “Accounts & Trade” tab in the top navigation menu.

- Select “Documents” from the drop-down menu.

- Select year-end tax documents.

- Look for forms such as: 1099 (investment income), 1099-R (retirement account distributions), 1042-S (foreign tax reporting), and any other tax-related documents.

- Click on the appropriate tax form to open and download it.

- Once the tax document is open, you can either click the “Download” button to download it directly or select the “Print” option to print it.

Schwab

- Log in to your Schwab account.

- Open a web browser and go to the Schwab website: schwab.com

- Click on the “Log In” button at the top right corner of the page.

- Enter your User ID and password, then click, “Log In.”

- Navigate to the Documents section.

- Select “Accounts” → “Statements and Tax Forms” and locate a list of available tax forms.

- Once you have selected and opened the tax document you want, you can either click the “Download” button to download it directly or select the “Print” option to print it.

- Find more information and detailed instructions at:

https://www.schwab.com/resource/how-to-find-your-tax-documents

DISCLAIMER: THIS MATERIAL PROVIDES GENERAL INFORMATION ONLY. COLDSTREAM DOES NOT OFFER LEGAL OR TAX ADVICE. ONLY PRIVATE LEGAL COUNSEL OR YOUR TAX ADVISOR MAY RECOMMEND THE APPLICATION OF THIS GENERAL INFORMATION TO ANY PARTICULAR SITUATION OR PREPARE AN INSTRUMENT CHOSEN TO IMPLEMENT THE DESIGN DISCUSSED HEREIN. CIRCULAR 230 NOTICE: TO ENSURE COMPLIANCE WITH REQUIREMENTS IMPOSED BY THE IRS, THIS NOTICE IS TO INFORM YOU THAT ANY TAX ADVICE INCLUDED IN THIS COMMUNICATION, INCLUDING ANY ATTACHMENTS, IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, FOR THE PURPOSE OF AVOIDING ANY FEDERAL TAX PENALTY OR PROMOTING, MARKETING, OR RECOMMENDING TO ANOTHER PARTY ANY TRANSACTION OR MATTER.

Related Articles

August 11, 2025

Required Minimum Distributions: Rules and Strategies

July 31, 2025

Qualified Charitable Distributions (QCDs) Are Gaining Momentum: How Retirees Are Rethinking Charitable Giving After the One Big Beautiful Bill (OBBB)

July 9, 2025

The “One Big Beautiful Bill”: Key Tax Provisions