Insights

December 6, 2024

What the 2024 Election Could Mean for Your Taxes

In Financial Planning, Tax Planning

Introduction

As the dust settles on the 2024 elections, one of the most pressing questions for many families is how the Republican Party’s return to unified control of the White House and Congress will shape the future of tax policy. With the Tax Cuts and Jobs Act (TCJA) set to expire at the end of 2025, we anticipate significant developments in the coming months that could impact income taxes, estate planning, and business deductions. Our Coldstream Wealth Strategy Group is closely monitoring these changes to help you stay informed and prepared for potential adjustments to your financial strategy.

In this post, we’ll outline the key provisions likely to be addressed, what’s expected to remain the same, and what could be up for negotiation in the next tax bill.

Key Takeaways

- Republicans are expected to extend much of the TCJA beyond 2025, though certain provisions may be amended or expanded.

- The current seven tax brackets and increased standard deduction are likely to remain unchanged.

- The $10,000 cap on State and Local Tax (SALT) deductions is expected to be a major point of negotiation, with potential changes ranging from raising the limit to full repeal.

- The Section 199A deduction for Qualified Business Income (QBI) is expected to continue, with possible increases tied to corporate tax cuts.

- Elevated estate and gift tax exemptions are likely to remain, reducing urgency for certain gifting strategies.

- Additional tax cuts proposed by the Trump campaign—such as eliminating taxes on Social Security income, tips, and overtime—may face significant legislative hurdles.

Potential Changes to Watch For

Under TCJA, the seven individual income tax brackets have stood at 10%, 12%, 22%, 24%, 32%, 35%, and 37%, as shown below:

| Tax Bracket | Single Filers | Married Filing Jointly |

| 10% | Up to $11,000 | Up to $22,000 |

| 12% | $11,001–$44,725 | $22,001–$89,450 |

| 22% | $44,726–$95,375 | $89,451–$190,750 |

| 24% | $95,376–$182,100 | $190,751–$364,200 |

| 32% | $182,101–$231,250 | $364,201–$462,500 |

| 35% | $231,251–$578,125 | $462,501–$693,750 |

| 37% | Over $578,125 | Over $693,750 |

These brackets are unlikely to change under an extended TCJA. However, other tax provisions, such as deductions and credits, could see significant revisions.

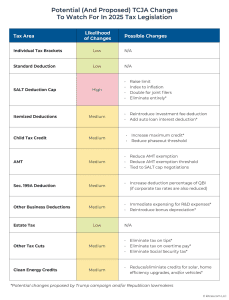

Below is a table highlighting some of the potential and proposed TCJA changes to watch for in 2025 legislation. Some key items to note include:

- SALT Deduction Cap: High likelihood of changes, including raising the cap, indexing it to inflation, or eliminating it entirely.

- Itemized Deductions: Proposals to reintroduce investment fee deductions and add auto loan interest deductions.

- Section 199A Deduction: Potential increases in the deduction percentage if corporate tax rates are reduced further.

- Estate Tax: Low likelihood of change, but elevated exemptions are expected to remain in place.

These changes will require careful planning to maximize benefits and minimize potential impacts on your financial strategy.

Looking Forward

As we await further clarity on how the next tax bill will shape up, it’s essential to remain proactive and adaptable in your financial planning. Whether it’s revisiting estate planning strategies, maximizing potential tax deductions, or evaluating opportunities to take advantage of current laws, we’re here to help you navigate these changes with confidence.

At Coldstream, our priority is to ensure that your financial plan remains aligned with your long-term goals, regardless of how the tax landscape evolves. If you have any questions or would like to discuss how these potential changes might affect your personal situation, please don’t hesitate to reach out.

Stay tuned for updates as we continue to monitor these developments and their impact on your financial future.

Credit:

This article draws heavily from insights shared by Ben Henry-Moreland in his Kitces article, “2024 Election: Evaluating The Impact Of A (Likely) Republican Trifecta On The TCJA Sunset And Tax Planning.” You can read the original article here.

*All of Coldstream’s staff shall attain the required licenses and designations necessary for his/her position. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP® and Certified Financial Planner™ in the U.S.

Insights Tags

Related Articles

January 27, 2026

Helping Your Child Complete Their First Tax Return

January 22, 2026

5 Questions to Ask When Selecting an Advisor

January 2, 2026

New Gifting and Contribution Limit Changes For 2026