Insights

May 29, 2025

Washington State Tax Changes: What Affluent Families and Business Owners Need to Know

In Financial Planning, Tax Planning

On May 20, 2025, Washington State Governor Bob Ferguson signed a $78 billion state operating budget into law, significantly expanding state spending on public services, education, childcare, and early learning. To fund these initiatives, the Washington State Legislature passed several major tax reforms that will affect many of the state’s high-income residents, business owners, and investors.

Among the most impactful pieces of legislation is Senate Bill 5813, which makes sweeping changes to the state’s estate and capital gains taxes. Two other bills—HB 2081and SB 5814—also introduce notable changes to the state’s tax structure, particularly affecting large businesses and professional service providers. Below is a breakdown of the key legislation and what it means for those with significant wealth or business interests in Washington.

Estate and Capital Gains Tax Increases (SB 5813)

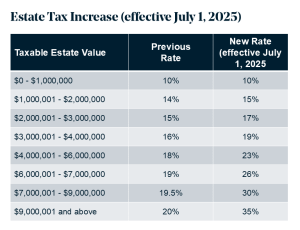

Effective July 1, 2025, Washington’s estate tax system will change in two important ways. First, the exemption amount will increase from $2.193 million to $3 million, with annual inflation adjustments going forward. Second, estate tax rates will rise across nearly every taxable bracket. For larger estates, this means heirs will experience a significantly higher tax burden on inherited wealth.

Source: Final Bill Report ESSB 5813

The additional estate tax revenue will be directed to the Education Legacy Trust Account, earmarked for K-12 schools, childcare, and higher education.

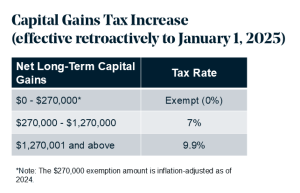

In addition, Washington’s state capital gains tax, originally passed in 2021, has been amended to raise the top rate. Effective retroactively to January 1, 2025, the capital gains tax rate increases from 7% to 9.9% on net long-term gains above $1.27 million. The new rate structure is tiered as follows:

Source: Final Bill Report ESSB 5813

With this increase, we recommend that families with large taxable estates or highly appreciated assets revisit their gifting strategies and liquidity planning. The increase in both capital gains and estate tax rates means that future tax bills could be substantially higher without proactive planning.

B&O Tax Increase and Surcharge for Large Businesses (HB 2081)

House Bill 2081 increases the Business & Occupation (B&O) tax for companies with more than $250 million in Washington receipts and adds a new 0.5% surcharge on income above that threshold. The surcharge takes effect January 1, 2026, and runs through the end of 2030.

Certain income types—such as manufacturing, prescription drugs, and petroleum processing—are exempt, and businesses already subject to the Advanced Computing Surcharge won’t be double-taxed.

While aimed at Washington’s largest corporations, this change may also affect fast-growing private businesses. Owners should revisit their entity structure and long-term growth plans in light of the new surcharge.

Expansion of Sales Tax on Services (SB 5814)

Senate Bill 5814 expands Washington’s sales tax base to include a wide range of professional services that were previously exempt. The new rules, effective July 1, 2025, could increase costs for businesses and families that rely on outside professionals, as well as those who offer such services themselves.

Service categories likely to be affected include consulting, legal, financial, and technical services. Family offices and closely held businesses that outsource work may face increased costs, and firms offering taxable services may need to reevaluate their billing practices.

What This Means for Washington’s Affluent Families and Business Owners

These tax law changes represent one of the most significant shifts in Washington’s tax landscape in recent years. For affluent families, business owners, and investors, they raise the stakes for careful and proactive planning.

If you fall into one of the following groups, we recommend a strategic review:

- Business owners or entrepreneurs, particularly those with fast-growing revenue

- Investors holding highly appreciated assets

- Families preparing for generational wealth transfer

- Service providers operating within Washington

Now is the time to review estate plans, model the impact of new capital gains rates, assess entity structures, and forecast exposure to the new sales tax rules. As always, we are here to help you evaluate how these changes apply to your unique circumstances—and identify opportunities to reduce risk and maximize after-tax outcomes.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP® and Certified Financial Planner™ in the U.S.

DISCLAIMER: THIS MATERIAL PROVIDES GENERAL INFORMATION ONLY. COLDSTREAM DOES NOT OFFER LEGAL OR TAX ADVICE. ONLY PRIVATE LEGAL COUNSEL OR YOUR TAX ADVISOR MAY RECOMMEND THE APPLICATION OF THIS GENERAL INFORMATION TO ANY PARTICULAR SITUATION OR PREPARE AN INSTRUMENT CHOSEN TO IMPLEMENT THE DESIGN DISCUSSED HEREIN.

CIRCULAR 230 NOTICE: TO ENSURE COMPLIANCE WITH REQUIREMENTS IMPOSED BY THE IRS, THIS NOTICE IS TO INFORM YOU THAT ANY TAX ADVICE INCLUDED IN THIS COMMUNICATION, INCLUDING ANY ATTACHMENTS, IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, FOR THE PURPOSE OF AVOIDING ANY FEDERAL TAX PENALTY OR PROMOTING, MARKETING, OR RECOMMENDING TO ANOTHER PARTY ANY TRANSACTION OR MATTER.

Related Articles

November 11, 2025

Multi-Generational Philanthropy: Gifting Structure Options

November 7, 2025

Year-End Charitable Gifting Deadlines

October 31, 2025

Maximizing Your Google Benefits: A Strategic Guide for 2026