Insights

September 30, 2022

The Triple Threat

In Market Commentary

High inflation, Fed rate hikes, and recession risk have resulted in the S&P 500 falling into bear market territory this year. They have also resulted in the US bond market having its worst year ever, failing to provide the diversification benefit that bonds have typically provided. For investors, the challenge is to be forward-looking instead of focusing on what has already occurred.

What is the status of inflation?

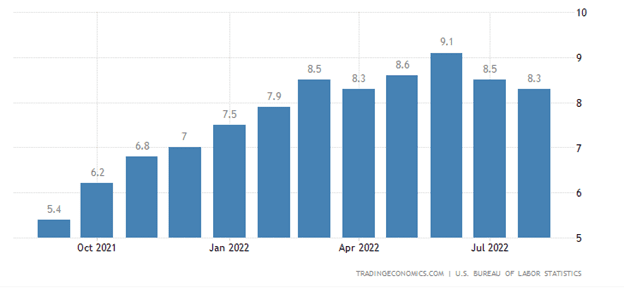

Both the stock and bond markets have been significantly impacted by the current inflationary environment. It appears inflation, as measured by the Consumer Price Index (CPI), has peaked but remains stubbornly high.

Over the course of the year the components driving inflation have changed, as “transitory” items such as supply chain bottlenecks and commodity prices are no longer the primary drivers of inflation, but the “stickier” components, such as housing, have become the main driver.

Source: JPMorgan

In addition, wage increases, while not a direct component of CPI, impact inflation, and we are seeing the beginnings of a wage price spiral, although nothing close to what the US experienced in the 1970s.

Source: JPMorgan

What Can the Fed Do about it?

The Fed is the body that can have the greatest impact on inflation in the US through rate hikes and balance sheet reduction (i.e., reducing the mortgages and treasuries it owns). By utilizing these two tools, the Fed should be able to reduce inflation by slowing the economy. Jerome Powell, the Fed Chair, has repeatedly stated that the Fed is committed to fighting inflation and implied that the Fed will do so, even if it causes a recession.

These Fed actions have and will continue to increase borrowing costs and cool the housing market, and supply chain shortages should continue to resolve over time. However, wage inflation may be more difficult to curtail. The US economy has lost approximately 5 million workers since the onset of COVID. While workers between the ages of 18 and 54 have largely returned to the workforce, those over 54 have not and probably will not return to the workforce. This shortage of workers may result in continuing wage pressures.

Source: JPMorgan

While the Fed’s actions should curtail demand and eventually address the labor shortage, the amount of time it will take to do so remains uncertain. We expect that inflation should continue to moderate, but the amount of time it will take to get to acceptable levels and what inflation rates will be going forward remain uncertain.

What are the risks of a Recession?

Is the US economy going into a recession? Economic signals in the US point in different directions. Some signals indicate that we are near, or even currently in, a recession. GDP was negative for the first and second quarters of this year, and the Conference Board’s Leading Economic Indicators have been falling for the last six months. By contrast, other signals show economic strength that typically does not happen in recessions. For example, corporate profitability rose over 8% in the second quarter, and job openings remain robust.

Officially, the National Board of Economic Research (NBER) determines if the US is in a recession and typically declares a recession well after the recession has started. If the US economy does fall into a recession, we expect it to be mild. The US economy was in a far stronger position coming into this year than it was coming into the significant recessions of 2001 or 2008. US households are not highly levered, and there are not the economic or market bubbles as there were in those two periods.

We also do not think the US economy will be in a prolonged stagflationary environment like the 1970s. There are significant differences between the 1970s and now. For example, energy was a much bigger part of the economy then, and Saudi Arabia and other Gulf states imposed an oil embargo on the US that caused gas prices to soar for an extended period. In the early 1970s, the U.S. government imposed wage and price controls, which fueled further inflation once those controls were removed. Additionally, the Fed maintained an accommodative monetary policy and did not raise rates until late in the decade. None of these issues are present now.

What Is the Impact on Financial Markets?

Early this year it was widely believed that the Fed was behind the curve in curtailing inflation. As a result, both the US equity and fixed income markets sold off. Markets rallied in June when the Fed made clear that it would do what it takes to curb inflation. The rally continued as economic data indicated the economy was cooling, and market participants anticipated that the Fed would not have to raise rates as aggressively as they had previously thought. However, in July the Fed made clear that it would continue raising rates aggressively, and the equity and bond markets reversed their respective rallies.

Source: Bloomberg

This market action reinforces our core belief that timing markets is a fool’s game. No one knows what the next piece of economic data will tell us, or what the Fed will do in the medium term, especially when there is no consensus among its members on how long it will take before they begin to reduce the Fed Funds rate.

Equity valuations for the S&P 500 appear to be reasonable, and for small cap stocks, valuations are as favorable as they have been since the Great Financial Crisis. However, if corporate profits do not meet analysts’ expectations, valuations, especially in large cap stocks, could become expensive again.

In fixed income, markets have re-priced to reflect Fed tightening and inflation. Absent runaway inflation fixed income may well again serve its traditional role as a hedge against an equity market decline. And for the first time in over a decade, fixed income yields are attractive.

We do expect continuing volatility until there are clear signs that inflation has been contained and the path of the Fed is clear. We believe any recession the US economy may fall into should be mild, and do not expect the degree of equity declines the US experienced in 2001 or 2008. The bulk of the equity and fixed income markets declines may be behind us, even if the US economy falls into a recession.

Historically, equity markets have sold off prior to a recession. During the recession, equity markets have anticipated the recovery and have rallied.

Most importantly, despite this year’s volatility and what happens to markets in the short term, we continue to strongly believe that sticking with your financial plan and maintaining portfolio diversification is the best way to meet your financial goals.

Related Articles

July 10, 2025

Watch Coldstream’s MarketCast for Third Quarter 2025

June 24, 2025

Managing Increased Uncertainty in the Middle East

June 4, 2025

Watch Coldstream’s Q2 2025 ISG Webinar