Insights

January 20, 2023

The End of an Era

In Market Commentary

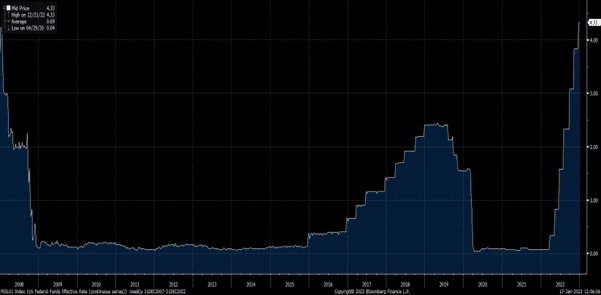

After the Great Financial crisis of 2008 and until 2020, the US economy was in a prolonged period of low inflation and relatively slow growth. During this period, the Fed thought it necessary to stimulate the economy to meet its 2% inflation target by keeping the Fed Funds rate low and buying bonds in the open market (Quantitative Easing). The result of this Fed intervention was that interest rates and bond yields remained extremely low, and US equity markets rallied as there were few other attractive investment alternatives to US stocks.

In 2020, the Fed dramatically increased its stimulus to combat the Covid-related economic shutdown by lowering the Fed Funds rate to 0. In addition, Congress provided cash directly to US households, those households purchased goods with that cash, thus increasing corporate profits in many sectors and creating a stock market rally. However, the inflationary after-effects of this stimulus required the Fed to switch course in 2022 and tighten economic conditions to curb the inflation that was the direct product of that stimulus. Instead of stimulating the economy to reach its 2% target, the Fed is attempting to slow economic growth by curtailing inflation through raising interest rates and ending Quantitative Easing. In 2022, it raised the Fed Funds rate at the fastest pace ever going from 0.25% in January to 4.25% – 4.50% at the end of the year. The long period of the Fed stimulating the US economy to spur inflation and growth has come to an end.

Federal Funds Rate

Source: Bloomberg

Recap of Last Year

Due to inflation and the Fed’s actions to curtail it, the US stock and bond markets both declined by double digits for the first time in almost 50 years.

Calendar Year Returns for the S&P 500 and the US Agg

Source: Morningstar, Inc.

Equity returns, however, varied depending on a company’s profitability. With higher interest rates, investors were less willing to pay a premium for companies that might become profitable sometime in the future. Accordingly, the stock price of “new economy” companies that had little, if any, current earnings declined far more than the stock price of profitable “old economy” companies with solid earnings; this is represented by the tech heavy NASDAQ 100 declining by 32.38% while the old economy focused Dow Jones Industrial Average declining by only 6.86%. Fixed income also sold off last year as the rate of inflation far exceeded the interest payments on most fixed income instruments resulting in the bond market having its worst year ever.

Almost all asset classes showed losses for the year, but, except for the NASDAQ 100, they rebounded in the fourth quarter as inflation appeared to have peaked and many of the supply chain disruptions that were fueling inflation seemed to have been resolved.

Where We Are Now

The Fed is trying to execute a “soft landing” by curtailing inflation and slowing economic activity without causing a recession. However, the Fed has indicated that its priority is to curb inflation even if its actions result in a recession. While inflation appears to have peaked, the Fed has indicated that it will continue to raise the Fed Funds rate as the inflation rate remains significantly above its 2% target rate, in large part because the labor market is extremely tight and the cost of shelter remains high.

Source: JPMorgan

There are many economic indicators, such as the ISM Purchasers Manufacturing Index, that show the Fed is succeeding in its efforts to slow the US economy, although the economy is not yet in a recession.

US ISM Manufacturing PMI®

Source: ISM®

Outlook

Whether or not the US economy falls into a recession is still in question, but any recession that does occur will probably be mild. US households have come into this economic slowdown in a healthy financial condition. Households still have excess savings, even though they are beginning to spend those down, and the labor market remains exceptionally strong.

Source: JPMorgan

Although these conditions could deteriorate, the current strength of US households and the labor market create an economic “cushion” as the economy slows that may well prevent a severe recession.

In fixed income markets, bonds have repriced, and for the first time in more than a decade, investors can earn a decent interest rate on their fixed income instruments. Accordingly, it is unlikely that fixed income will suffer the same magnitude of losses that the asset class suffered in 2022.

In the equity markets, US large-cap equities are no longer highly overvalued, and US small- and mid-cap equities valuations remain well below their historical averages. However, those valuations are based on forward earnings estimates. Analysts have been reducing those estimates, but it is not clear whether they have reduced them enough to account for an economic slowdown or recession. This and next quarters’ earnings will be a major factor in determining the direction of the US equity markets this year.

Issues Outside the Financial Markets that Could Affect Those Markets

While volatility in the financial markets has lessened since the third quarter of last year, there are currently several geopolitical events that could spur an increase in volatility. Internationally, an expansion of the Russia/Ukraine war or a confrontation with China over Taiwan would likely cause financial market volatility. Domestically, a failure to raise the debt ceiling limit could create significant volatility as well.

In regard to the international conflicts, it is impossible to predict how they will play out, and Coldstream is not a “global macro” hedge fund that makes bets on how those conflicts are resolved. As to the debt ceiling, while there will probably be significant market volatility if Congress cannot agree to raise the debt ceiling initially, we think it will have to reach an agreement eventually at which time financial markets may well return to their pre-debt ceiling crisis levels. While we will be monitoring the debt ceiling negotiations closely, we are not day traders who will attempt to buy and sell based on the timing of debt ceiling negotiations.

Our Philosophy

While we may make relatively small tactical moves in client portfolios, we will always abide by the principal of diversification as the best way to meet your financial goals. While the range of returns is wide and unpredictable in the short term, they are much narrower and more dependable over time.

Source: JPMorgan

We thank you for your trust in us. If you have any questions, please feel free to contact me, your Portfolio Manager, or your Wealth Manager.

Related Articles

July 11, 2025

The Return of Diversification

July 10, 2025

Watch Coldstream’s MarketCast for Third Quarter 2025

June 24, 2025

Managing Increased Uncertainty in the Middle East