Insights

April 24, 2023

First Quarter Market Commentary

In Market Commentary

“The Future Ain’t What It Used to Be” – Yogi Berra

Economic data indicates that the US economy is currently doing well. Inflation is high but appears to have peaked last year, US households continue to be in good financial condition, jobs are plentiful, corporate and consumer defaults remain low, and GDP was positive for the third and fourth quarter of 2022 and is projected to be positive for the first quarter of 2023.

With declining inflation and decent economic data, both the US equity and fixed income markets rallied in the first quarter, with the S&P 500 gaining 7.50% and the Bloomberg US Aggregate Bond Index gaining 2.96%. Within equities, there was a significant reversal in leadership from last year when market participants were concerned about both accelerating inflation and declining prospects for growth. At that time, growth stocks with lofty valuations suffered much larger declines than dividend-paying value-oriented companies. This year, this pattern reversed; growth stocks have far outperformed value stocks with the tech-heavy, growth-oriented NASDAQ returning 17.05% YTD and the value-oriented Dow Jones Industrial Average returning only 0.93%.

From Where We Are to Where We Are Going

Forward-looking economic indicators, however, present a more nuanced picture for the US economy. The Conference Board’s Leading Economic Index (LEI) has been negative since the middle of last year, and the US Treasury Yield Curve is inverted. Each of these occurrences has been an historically reliable predictor of an upcoming US recession in the near to medium term.

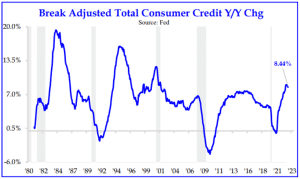

While households remain in good financial condition, some cracks are starting to show. Credit card usage is increasing, and households are spending down their excess savings from the pandemic.

Source: Stategas

Inflation, while declining, is still at 6%. Even the jobs market, although still strong, is showing some early signs of weakening as layoffs have begun to increase and job openings have decreased.

Source: JPMorgan

This data has caused many forecasters to predict a recession will occur in 6 months to a year. However, in 2022, many forecasters were also predicting a recession 6 to 9 months from then, and no recession has materialized yet.

Two Issues We Are Particularly Focused on for Markets and the Economy – Regional Banks And Corporate Profits

At the beginning of 2022, the Fed Funds rate was at 0.25%. To fight inflation, the Fed raised the Fed Funds rate to 4.75% by the end of the first quarter of 2023 – the fastest increase in 40 years. This rise in rate has had a significant impact on regional banks in two ways. First, banks use checking and savings account deposits to make loans and fixed income investments. Prior to the Fed raising rates, these loans and investments had very low yields. As interest rates rose, the value of these low-yielding assets declined. At the same time, bank customers withdrew money from their checking and savings accounts and put them in Money Market Funds (MMFs) as MMFs were paying far higher interest rates than checking and savings accounts.

This pattern intensified significantly after Silicon Valley Bank (SVB) collapsed[1] as customers were concerned about the safety of their checking and savings account deposits.

Source: JPMorgan

While SVB was unique in the severity of its exposure to these events, many regional banks have had a significant decrease in their deposit base. Although we are not concerned about systemic risk to the financial system after the SVB collapse, we are watching how severely banks will curtail lending as the decrease in their deposit base and the value of their investments limits the funds they have available to lend. Such a decrease in lending could slow economic activity and make a recession more likely.

The second issue we are focused on is corporate profitability. Corporate profits declined 3.2% in the fourth quarter of 2022 from the previous quarter although revenues increased 5.8%. The decline was primarily due to margin pressure from rising labor and other costs. Analysts are still predicting a rebound in corporate profitability in the third and fourth quarter of this year, although they have revised their estimates downward over the last year.

Source: Bloomberg

If corporate profits do not meet analysts estimates, this could result in another leg down in the equity markets.

The Fed’s Predicament

In attempting to curtail inflation without causing the US economy to go into a recession, the Fed is walking a tightrope. If it continues to raise rates aggressively, it risks severely contracting bank lending, which could precipitate a recession. However, if it stops raising rates too soon, it risks reversing the progress it has made to date on curbing inflation and repeating the mistakes of the 1970s Fed when it stopped raising rates too soon causing inflation to become embedded in the economy. It is a difficult predicament with no foolproof answer. However, if the two most recent US bouts with inflation serve as a guide, we can expect inflation to gradually decline but over a longer time-period than most economists are predicting.

Source: The Daily Shot

As we have stated previously, given the current strength of US households and the job market, we think if the US economy does go into a recession, it will probably be a mild one.

What This Means to You

The message remains the same: the best way to achieve your financial goals is to maintain diversification and not try to time the market. The significant reversal in market leadership from last year to this year demonstrates this clearly. An investor chasing returns last year may have switched to investing in value-oriented companies. That investor would have been “whipsawed” this year as those companies have underperformed growth-oriented companies significantly. An investor would have to time the switch first to value and then back to growth perfectly, and we do not think anyone can do that on a consistent basis. Although we do think small tactical shifts can add value to a portfolio, it should not be at the expense of overall diversification. Sticking to your financial plan gives you the best chance of reaching your financial goals.

We thank you for your trust in us. If you have any questions or comments, feel free to contact your Wealth Manager, your Portfolio Manager, or me.

[1] We wrote about the collapse of Silicon Valley Bank in our last letter to you, and refer you to that letter for a discussion of why that bank collapsed.

Related Articles

June 24, 2025

Managing Increased Uncertainty in the Middle East

June 4, 2025

Watch Coldstream’s Q2 2025 ISG Webinar

April 14, 2025

Watch Coldstream’s MarketCast for Second Quarter 2025