Insights

October 3, 2022

Introduction to Medicare

In Insurance, Wealth Strategy

If you’re over 65, chances are you’re familiar with Medicare. Some 64 million people are enrolled in Medicare today. But many Americans have little knowledge of this government-run health insurance program, which plays an important role in your retirement planning.

What does Medicare cover?

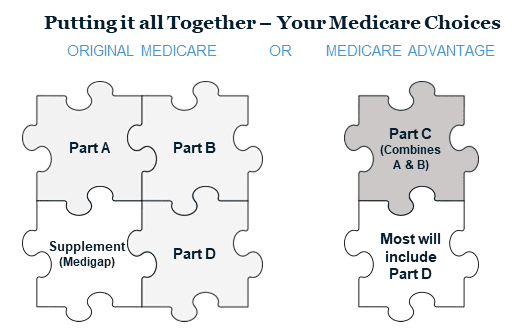

Medicare includes four types of coverage—Parts A, B, C and D.

Part A is Hospital Insurance, which covers inpatient care in hospitals, skilled nursing facility care for up to 100 days, hospice care and home health care. Most people do not pay premiums, but the plan does include deductibles and co-pays.

Part B is Medical Insurance, which covers roughly 80% of doctor services, outpatient care, lab work and X-rays, home health care, physical and occupational therapy, durable medical equipment like MRIs and CT scans, and some preventive services. Enrollees pay premiums plus an income-related monthly adjustment in addition to deductibles and co-pays.

Part D is Prescription Drug Coverage provided by private insurers. Providers typically cover most generic drugs, but not all brand names. Premiums depend on the type of coverage selected plus an income-related monthly adjustment.

Medigap or Supplemental Insurance are private insurance programs that help offset co-pays and deductibles not covered by Medicare. There are 12 plans to choose from which are identified by letters A-N. All policies offer the same basic benefits regardless of which insurance company you purchase them from, but some plans offer additional benefits such as coverage of up to $50,000 for emergency care outside of the U.S.

A large majority of our clients over the age of 65 choose a combination of Medicare Parts A + B + D, supplemented by a Medigap policy because they like having the ability to see any provider covered by Medicare. This combination of policies is referred to as Traditional Medicare.

What about Part C? Also known as Medicare Advantage, Part C plans are offered by private insurers as an alternative to Traditional Medicare. Coverage is usually limited to a network of providers. These plans cover the same services as Part A and Part B and usually include Part D benefits. They may also offer some coverage for vision and dental. Clients may decide to choose a Medicare Advantage Plan if their providers are already in-network, and they want a plan with no limit on emergency care outside the U.S. These premiums may be lower than Traditional Medicare, but out-of-pocket costs vary significantly.

What does Medicare cost?

Much of the funding for Medicare comes from a 2.9% payroll tax, split equally between employers and employees. But individuals must pay premiums, co-pays and other out-of-pocket costs that can vary considerably.

Historically, Medicare costs have increased 6% per year. When planning for health care costs, we combined base premiums (adjusted based on your expected income level) plus additional amounts for expected out-of-pocket costs including dental and vision, specialized care or prescription drugs, and other individual health care needs. We inflate these costs at a rate higher than average inflation to reflect how health care costs have risen more quickly and significantly than other spending areas.

On average, a new Medicare subscriber (not including income-based adjustments in Part B and Part D premiums) will pay at least $5,400 per year for premiums and out-of-pocket costs.

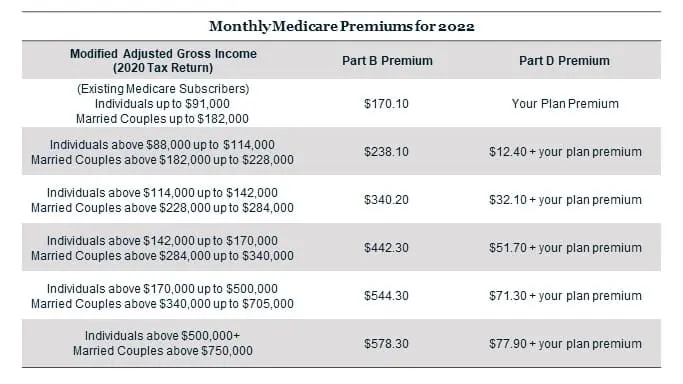

What is IRMAA?

IRMAA stands for Income-Related Monthly Adjusted Amount and refers to the income-based adjustments to Part B and Part D premiums. Interestingly, IRMAA is based on your Modified Adjusted Gross Income from two years ago. The chart below explains how your 2022 Medicare premiums would be impacted by your 2020 income level.

How do I sign up for Medicare?

It is important to note that eligibility for Social Security benefits is not connected to Medicare eligibility. However, if you are 65, retired, and receiving Social Security payments, you are automatically enrolled in Medicare Part A and Part B. You may decline Part B, but you will incur financial penalties unless you have comparable coverage under an employer-sponsored plan. Note that does not include COBRA or retiree health care plans.

If you are 65 and not yet receiving Social Security benefits, Medicare enrollment is not automatic. You have a seven-month sign-up window which begins three months before the month you turn 65 and ends three months after the month you turn 65. You may also sign up for Part A and/or Part B between January 1 and March 31 each year (although late enrollment penalties may apply if you miss the initial enrollment period). The online application can be found here. The process is simple, with no forms to sign and no documentation required.

Part D enrollment is also optional. You may defer enrollment with no penalty if you have coverage which provides similar prescription drug benefits. However, someone without alternate coverage will pay higher rates if they choose to enroll later. For most retirees, it typically makes sense to enroll in Part D up front to protect against unforeseen expenses down the road. Changes to existing Part A, B and D Medicare can be made annually during the Annual Election/Open Enrollment Period which runs from October 15th through December 7th.

Furthermore, some enrollees may want to consider protecting their assets with additional long-term care insurance. Long-term care coverage can help offset the cost of nursing home care, assisted living, and home health care services, which are not covered by Medicare or Medigap policies. You can visit longtermcare.acl.gov for additional resources, read this Coldstream article on Long-Term Care, or ask your Coldstream advisor for tailored advice.

If you are close to retirement, it might make sense to check whether your doctors currently participate in the Medicare program. You can also review Part D providers to see which ones cover your current prescriptions. You can find more information at www.medicare.gov or by calling 1-800-MEDICARE.

Making Medicare Decisions

Your health care decisions could require considerable research and preparation. Your Coldstream advisor can help you assess your needs and include health care coverage into your long-term financial plan. We would be happy to refer you to a Medicare specialist who can help you understand your coverage options and provide guidance in selecting the optimal plan.

Insights Tags

Related Articles

June 27, 2025

Diversified Estate Planning for LGBTQ+ Families

June 20, 2025

Incorporating a “Die with Zero” Philosophy into Your Long-Term Financial Plan

June 1, 2025

Maximizing Your Google Benefits: A Strategic Guide for 2025