Insights

February 12, 2025

Does My Child Need to File a Tax Return?

In Family Needs, Tax Planning, Wealth Strategy

Your teenager may have had their first job working at the snack shack last summer, and their W2 just arrived in the mail. Or perhaps you collectively decided to sell some of the gifted Microsoft stock from their custodial account so your teenager could purchase their first car. Now you’ve received a 1099 and wonder if your child needs to file their own tax return. We’re here to shed some light on the most common situations in which your dependent child will need to file their own tax return.

A Summer Job or Internship If Paid Over $14,600

If an employer pays your child more than $14,600 (in tax year 2024) and you typically claim your child as a dependent on your tax return, your child is required to file their own tax return.

Your child is considered a dependent if they 1) reside with you for more than half the year, 2) provide less than half of their own financial support, and 3) are under the age of 19 at all times during the tax year, or under the age of 24 if a full-time student. If your child is attending college, you may still claim them as a dependent even though your child does not physically live with you during the year.

The income threshold of $14,600 only applies to “earned income,” which means income generated through a job.

Investment Income Over $1,300

What if your child didn’t have earned income, but instead had significant investment income (the IRS calls this “unearned income”) such as interest and dividends? We see this situation often — where a parent or grandparent gifts stocks to children. It’s a great way to introduce them to investing and give a gift that grows over time. Income from investments in a child’s name (or in a custodial account designed for a minor) is considered “unearned income.” This includes interest, dividends, and capital gains from the sale of stocks, bonds, or other securities. If unearned income exceeds $1,300 (tax year 2024), then your child is required to file an income tax return. If your child is under the age of 19 (or under the age of 24 if a full-time student), you may elect to report your child’s investment income on your return to avoid your child having to file a separate return. However, if your child’s unearned income exceeds $13,000, they must file their own tax return. It’s important to note that unearned income that exceeds $2,600 will be taxed at the parents’ tax rate, unless the child’s tax rate is higher.

A More Complex Combination of Earned and Unearned Income

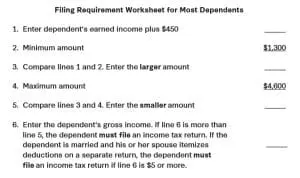

The filing requirements are pretty straightforward if you only have earned income or unearned income. But what if your child has a combination of both? In this instance, both amounts are added together; if the total of earned and unearned income is greater than $1,300, then they are required to file an income tax return.

The IRS has a worksheet that can be helpful in determining whether a dependent with earned and unearned income is required to file a tax return.

The IRS website has an online interactive tool that can be helpful in determining if filing a return is needed.

Other Instances Where Your Child May Want to File a Tax Return

Refund or Tax Credit Eligibility: Even if earned income falls below the filling threshold, if the employer withheld taxes, your child may want to file a return as they could be eligible for a refund. If your child qualifies for any tax credits, this may be another reason your child would want to file a return (although most tax credits require that you are not claimed as a dependent).

IRA Contributions: If your child makes a deductible IRA contribution with their earned income, this will require filing a tax return. However, contributions to a Roth IRA are excluded from this rule and would not require filing a tax return. We encourage most young savers to start a Roth IRA so they can benefit from tax-free growth over time. Keep in mind your child can only make an IRA contribution up to the amount of their earned income with a maximum contribution limit of $7,000 per year (2024 limit).

Independent Children: If you don’t claim your child as a dependent on your tax return, they must file if their taxable income exceeds $14,600 from all sources (earned or unearned).

If you have any questions, please reach out to your Coldstream wealth management team.

Additional Resources

*All of Coldstream’s staff shall attain the required licenses and designations necessary for his/her position. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP® and Certified Financial Planner™ in the U.S.

DISCLAIMER: THIS MATERIAL PROVIDES GENERAL INFORMATION ONLY. COLDSTREAM DOES NOT OFFER LEGAL OR TAX ADVICE. ONLY PRIVATE LEGAL COUNSEL OR YOUR TAX ADVISOR MAY RECOMMEND THE APPLICATION OF THIS GENERAL INFORMATION TO ANY PARTICULAR SITUATION OR PREPARE AN INSTRUMENT CHOSEN TO IMPLEMENT THE DESIGN DISCUSSED HEREIN. CIRCULAR 230 NOTICE: TO ENSURE COMPLIANCE WITH REQUIREMENTS IMPOSED BY THE IRS, THIS NOTICE IS TO INFORM YOU THAT ANY TAX ADVICE INCLUDED IN THIS COMMUNICATION, INCLUDING ANY ATTACHMENTS, IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, FOR THE PURPOSE OF AVOIDING ANY FEDERAL TAX PENALTY OR PROMOTING, MARKETING, OR RECOMMENDING TO ANOTHER PARTY ANY TRANSACTION OR MATTER.

Insights Tags

Related Articles

June 27, 2025

Diversified Estate Planning for LGBTQ+ Families

June 20, 2025

Incorporating a “Die with Zero” Philosophy into Your Long-Term Financial Plan

June 9, 2025

Helping children build wealth of their own: why the Roth IRA is an important gifting vehicle.