Insights

October 11, 2023

Beware of IRMAA: How to Avoid Medicare Premium Surcharges

In Insurance, Wealth Strategy

Halloween overlaps with Medicare open enrollment, which in 2023 is happening between October 15th and December 7th. In the spirit of this festive season filled with ghosts, goblins, and ghouls, we want to warn you of another unwelcomed visitor that may spook you: IRMAA surcharges on your Medicare premiums (queue eerie music)! Read on to learn how to avoid Medicare Premium Surcharges.

What is IRMAA?

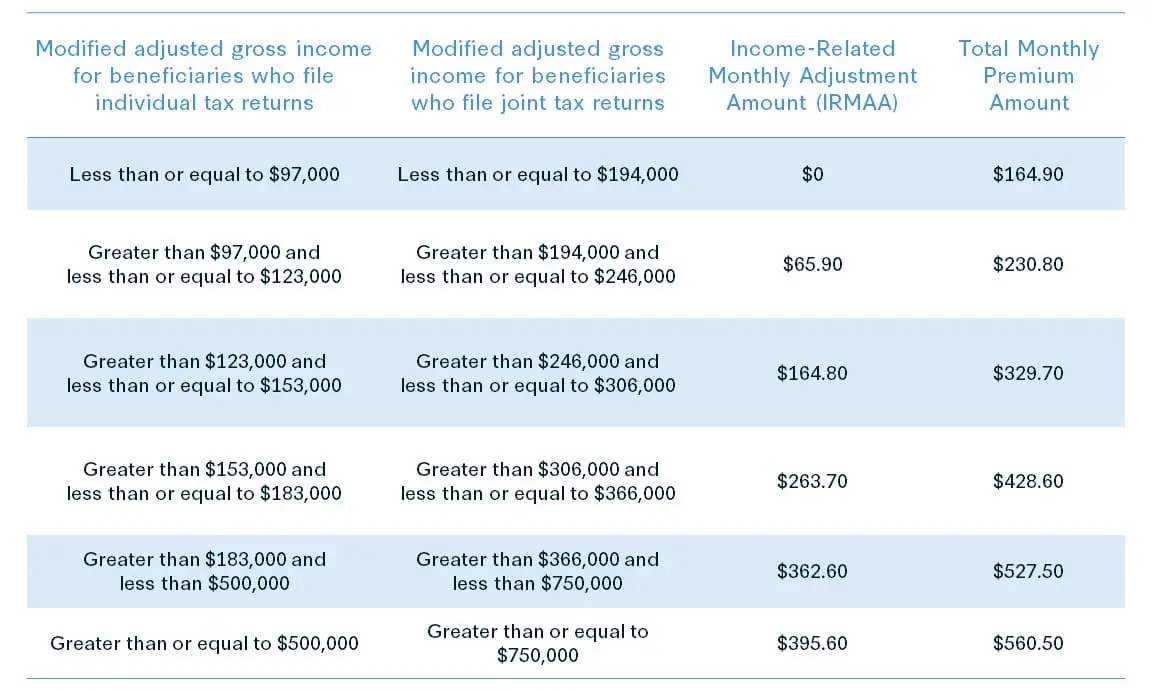

IRMAA stands for Income-Related Monthly Adjustment Amount, a new provision enacted by Congress in 2003 and expanded in 2011. IRMAA is a surcharge on your Medicare premiums for parts B (medical insurance) and D (prescription drug plan). It is based on modified adjusted gross incomes (MAGI) at or higher than $97,000 for individuals or $194,000 for married filing jointly couples. Up to five tiers of additional surcharges range from $78.10 to $472.00 monthly per person.

The surcharge is based on your MAGI from two years ago. Thus, your premium rates and IRMAA surcharges for 2024 will be based on your MAGI from 2022.

IRMAA applies to all types of Medicare plans, including Medicare Advantage. If you are subject to paying IRMAA surcharges, you will receive a mailed notification from the Social Security Administration. We recommend holding onto this letter in case you wish to appeal. It will automatically be adjusted if you withhold your Medicare premiums from monthly Social Security payments. You will see the surcharge notated on your monthly bill if you do not withhold your Medicare premiums from Social Security.

Unfortunately, IRMAA is unique because there are no phase-outs for reaching specific thresholds. If you are just one dollar over a threshold, you will pay a significantly higher amount for your Medicare premium. This means your one dollar over the threshold could cost you tens or hundreds of extra premium dollars annually.

PART B ADJUSTMENTS

Source: Kindness Financial Planning

PART D ADJUSTMENTS

Source: Kindness Financial Planning

Appealing IRMAA

There are limited qualifying events to appeal IRMAA premium increases. The list includes life-changing events such as:

- Marriage

- Divorce or annulment

- Death of your spouse

- Work stoppage

- Work reduction

- Involuntary loss of income-producing property

- Loss of pension income

- Employer settlement payment due to its closure or bankruptcy

You can also appeal if:

- The IRS data contained an error on your tax return.

- The IRS sent old data, and you’d like them to use newer information on your tax return.

- A beneficiary filed an amended tax return for the year the Social Security Administration used to make the IRMAA decision.

You might also try to appeal for other reasons, such as having an abnormally high MAGI from something like a sale that generates a large amount of capital gains. Since this reason is not on the list, you might have a much harder time convincing Social Security to allow this type of exemption.

If you retired within the two years leading up to beginning Medicare at age 65, ask if you qualify for an exemption due to work stoppage to avoid paying rates based on your earned income pre-retirement.

To appeal your IRMAA determination, fill out the Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event form or schedule an interview with your local Social Security office (1-800-772-1213). This should be done within 60 days of receiving your IRMAA notice.

Utilizing Financial Planning to Avoid IRMAA

With careful attention, it might be possible to implement planning strategies to lower or eliminate the IRMAA surcharge.

Some people experience a taxable income increase in retirement. Withdrawals and income from pensions, Social Security, and regular or Required Minimum Distributions (RMDs) from IRAs can sometimes generate a similar or higher amount of taxable income. This can be especially pertinent if most of your retirement savings are held within pensions or pre-tax retirement accounts.

Some financial planning strategies you might consider:

- Make charitable contributions to lower your MAGI. For larger donations, a Donor-Advised Fund may make sense for your plan.

- Utilize Roth IRA funds instead of an IRA for some cash withdrawals.

- Spread out withdrawals for cash needs across a few years. For example, if you need $80k for a new car, you could take half of the amount from an IRA in December and the other half in January once the new year begins.

- If you have earned income, continue to make tax-deductible retirement contributions.

- In lower tax years, convert funds from a Traditional IRA to a Roth IRA via a Roth conversion. There may be a few years between retirement and when Social Security and RMDs begin, resulting in a few years with a lower tax bracket. Consider utilizing the lower tax bracket to complete a Roth conversion. This can help lower the tax impact of the RMDs that begin between the ages of 73 and 75.

In a perfect world, we would all like to avoid IRMAA surcharges, but it’s important not to lose sight of the bigger financial picture. IRMAA thresholds are just one of many factors when it comes to building out an optimized investment and tax planning strategy. Ask your Coldstream advisory team how you may be affected by IRMAA surcharges and if you can implement any of these strategies into your plan.

Sources:

How to Avoid an IRMAA Medicare Premium Surcharge

Medicare IRMAA Brackets

Request to Lower an Income-Related Monthly Adjustment Amount (IRMAA)

www.Medicare.gov

Part B Costs for Those with Higher Incomes

What is the Medicare IRMAA?

Some Medicare Beneficiaries are Surprised with Premium Surcharges

How to Avoid the IRMAA Surcharge and Pay Less for Medicare

Image by senivpetro on Freepik

Related Articles

June 27, 2025

Diversified Estate Planning for LGBTQ+ Families

June 20, 2025

Incorporating a “Die with Zero” Philosophy into Your Long-Term Financial Plan

June 1, 2025

Maximizing Your Google Benefits: A Strategic Guide for 2025