Insights

January 17, 2013

A Pending Bond Bear Market?

In Uncategorized

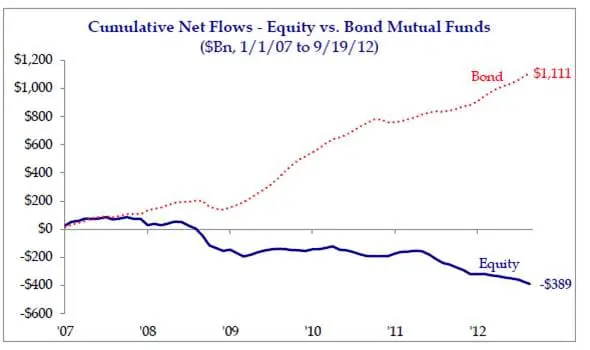

In the aftermath of the tech bubble, the housing bubble, Wall Street scandals and the near collapse of the financial system, many ordinary investors have lost faith in the equity markets. In an effort to reduce the risk in their portfolios, retail investors have exited equity mutual funds while bond funds have seen large inflows (see chart below). Investors have accepted the lower return of fixed income assets in exchange for lower volatility and more certain cash flows. Unfortunately, these investors may be in for a far rockier road than they had anticipated; we believe the current very low yields on fixed income instruments do not compensate investors for the risk that is building in the asset class.

The current low yield environment has been underpinned by the Federal Reserve’s purchases of Treasury and mortgage backed securities – quantitative easing – that the Fed has signaled will remain in place until the US economy has seen a meaningful improvement in unemployment and continued low inflation. This QE-Infinity has not only kept interest rates low, it has fueled the rally in the US stock market to near new highs.

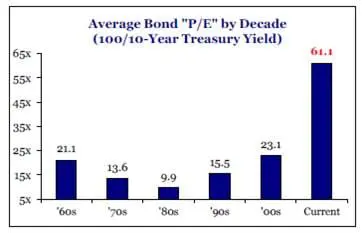

The “Average Bond P/E by Decade” chart shows the average price earnings ratio by decade of the 10 year US Treasury, which is calculated by dividing 100 by the 10 year Treasury yield. The chart illustrates how far the current Treasury price earnings ratio is skewed versus the prior five decades . Even an untrained eye can see that there is a bubble in high quality fixed income assets.

Just as Federal Reserve chairman Alan Greenspan warned of “irrational exuberance…unduly escalating asset values” in a December 1996 speech, only to see the bull market continue for another three years, we do not know the path that bubble will take or how long until it bursts. We do know, however, that the global overweight to fixed income is long in the tooth.

Global yields spiked following the release of the Federal Reserve December Federal Open Market Committee meeting notes, which showed rising concern about the Fed’s policy of buying bonds to stimulate growth and several of the central bank’s officials leaning toward slowing or stopping purchases well before the end of 2013,. (Bond prices and bond interest rates move in opposite directions. When rates rise, bond prices fall because the value of the bond decreases.)

We don’t believe that a change in Federal Reserve policy is imminent; the global economy is still weak and awash in excess capacity. That said, the sharp reaction to the still preliminary discussion about unwinding the quantitative easing bond purchases indicates that market participants have a heightened awareness of the risks associated with the reversal of the Federal Reserve’s current policies. This heightened awareness will mean continued knee jerk selling to any negative news on the inflation front or other hawkish sentiments from the Federal Reserve members.

When the Federal Reserve does reverse its policy, we believe there will be a stampede for the exits causing yields to spike. Investors who plowed into bonds to create a safe haven for their assets could get blown up once again as the bond bubble bursts, particularly those who stretched for yield in longer dated bonds. But all is not gloom and doom; there are ways to mitigate the volatility of a bond portfolio, even in a rising interest rate environment.

Like a teeter-totter, bond prices and interest rates move in opposite directions; as interest rates rise, bond prices decline. The three factors that influence the variability of bond prices to a given change in interest rates are the time to maturity, the coupon and the quality of the underlying issuer. All else being equal, high quality, high coupon bonds with short maturities will have less price variability to a given change in interest rates than long dated bonds, low coupon and low quality bonds.

There is any number of reasons that owning fixed income securities in client portfolios might make sense; each client situation is unique. We urge you to review your fixed income portfolio with your Coldstream Portfolio Manager or Relationship Manager to make sure you understand what you own, why you own it, and how those securities might react when interest rates finally do start to normalize.

By Elaine Heller, CFA

Relationship Manager

Related Articles

April 3, 2020

COVID-19 Monitoring Resources

November 25, 2019

Detlef’s Interview with Chase Jarvis

April 15, 2019

The Underwriting of a Construction Loan Through the Eyes of a Lender