Insights

June 17, 2022

A Difficult Year

In Investments, Market Commentary

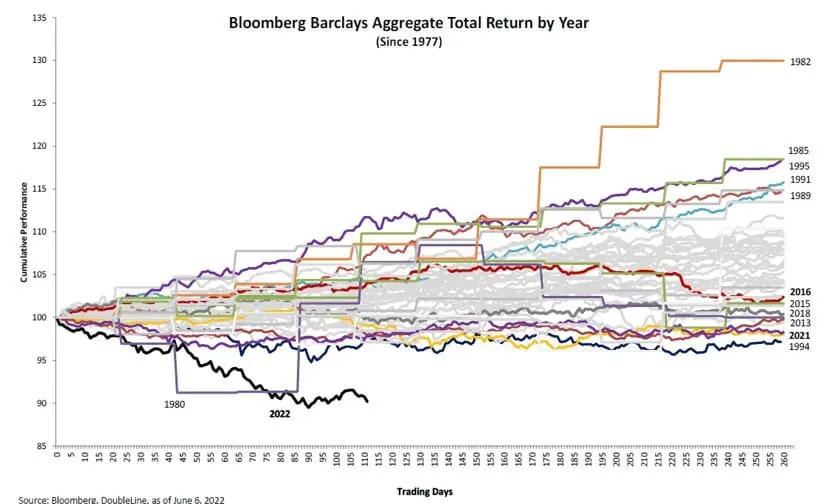

Both the equity and fixed income markets globally have experienced significant drawdowns this year, due, primarily, to inflation. The U.S. equity market is now in a bear market, down approximately 25% from its highs, and the protective role that bonds usually play when equity markets fall has not materialized this year. When equity prices fall, investors typically rush into the safety of bonds causing prices to rise and interest rates to fall. With inflation, investors have avoided bonds as the interest payments on a fixed-rate bond become less attractive as inflation rises. This dynamic has resulted in the common benchmark for U.S. fixed income, the Barclay’s U.S. Aggregate Index, to experience its worst year in over 40 years.

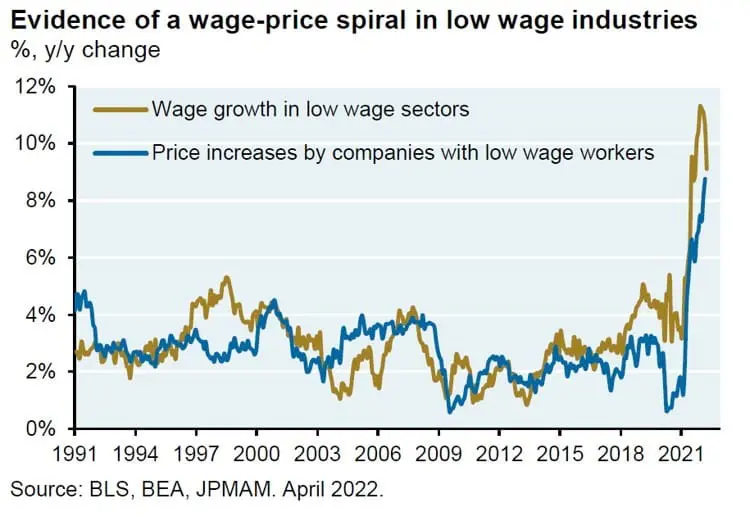

There are numerous reasons for the current bout of inflation, but the most significant ones are: (1) the monetary and fiscal stimulus provided by the Fed and Congress to support the economy during COVID created increased consumer demand, (2) supply chain disruptions and production cutbacks from COVID resulted in diminished supply, (3) job openings have exceeded the number of workers looking for jobs so wages have increased, and (4) Russia’s invasion of Ukraine contributed to a spike higher in commodity prices. As a result, the U.S. economy is now experiencing a “spiral” in wages and prices.

The body with the best tools to fight inflation in the U.S. is the Fed. It can do so by raising the Fed Funds rate, which ultimately results in higher borrowing costs, and, thus, slowing lending and decreasing demand. It is widely recognized (including by the members of the Fed) that the Fed did not react to the early signs of inflation quickly enough as it thought that inflation was “transitory” and would resolve itself. As a result, it did not raise the Fed Funds rate or curtail its program of buying Treasuries and mortgages, which actually stimulates the economy, until April 2022.

The Fed has recognized its mistake and at its meeting on Wednesday June 15th raised interest rates by .75%, the largest increase since 1994. The Fed has made it clear that curtailing inflation is now its primary goal, even if it means increasing the unemployment rate or putting the economy into a recession. As a result, the probability of a recession within a year has significantly increased.

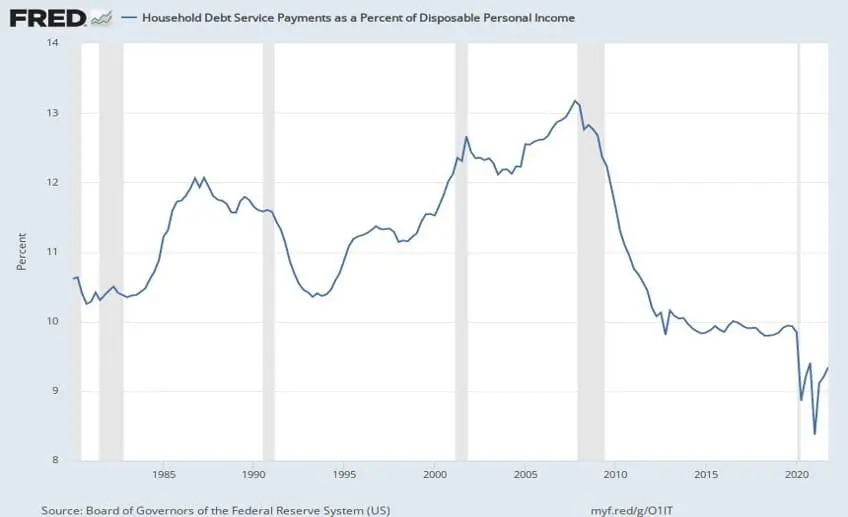

Recession is a broad term, and the severity of any given recession varies greatly. For example, the recession of 2008 was severe because financial institutions were so over-levered that once the economy began to slow, their very solvency was at-risk. In addition, household leverage was at historic highs and savings were low. By contrast, currently, there are many aspects to the U.S. economy that are strong: household debt to income is low, financial institutions are well-capitalized, the labor market is strong, and corporate profitability remains robust, although slowing.

Is It Time to Sell?

Some clients have asked us: (1) whether they should decrease their equity exposure given that we may be entering a recession, and (2) whether they should own bonds at all as bonds have failed to protect portfolios this year. While each client’s circumstance is different, we do not recommend either reducing equity exposure or liquidating your bond portfolio.

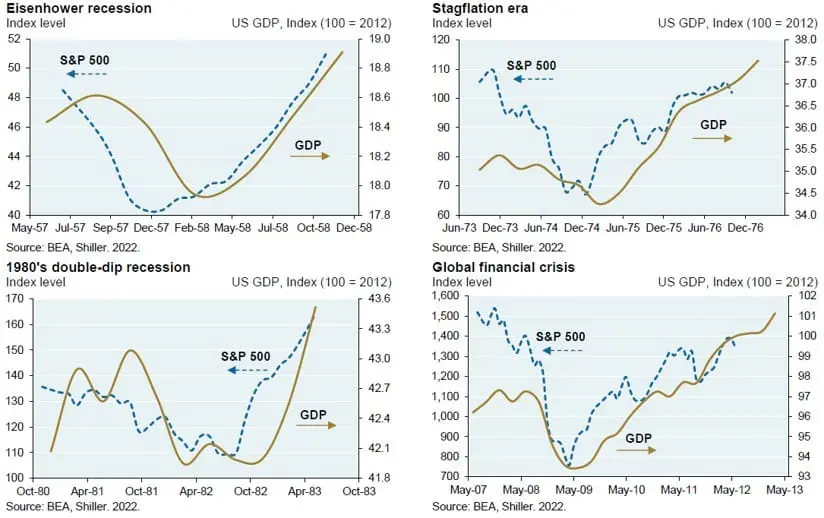

Historically, equity markets have anticipated recessions and declined significantly before a recession occurs. Once the economy enters into a recession, equity markets have looked forward and started to recover. Currently, the U.S. equity markets have begun to price in a recession. While that does not mean markets could not fall further in the short run, the current economy does not resemble the economy in those periods where it has fallen into a deep recession, such as 2008, and equity prices reached extremely low levels. Further, valuations in U.S. large cap stocks generally appear reasonable with many small- and mid-cap stocks having very attractive valuation levels. While no one can “call the bottom” of a bear market, exiting equity markets now could cause an investor to crystallize losses with the danger of not participating in a subsequent rally.

In regard to bonds, they have already re-priced to reflect both inflation and anticipated future Fed rate hikes. As bond prices have fallen, their coupons have increased, enabling investors who buy bonds to earn some level of interest on their bonds for the first time in a while. Most importantly, if the economy does fall into a recession, and especially if the recession is more severe than anticipated and the economy slows drastically, bonds, and especially Treasuries, should rally and be protective of an investment portfolio.

We expect that the phenomenon of the simultaneous falling equity and bond prices will not persist in the long-term and that portfolio diversification is still the best method of achieving your financial goals.

Insights Tags

Related Articles

June 24, 2025

Managing Increased Uncertainty in the Middle East

June 4, 2025

Watch Coldstream’s Q2 2025 ISG Webinar

May 12, 2025

Why people make irrational financial decisions