Insights

October 14, 2014

Third Quarter Choppiness – Where Do We Go from Here?

In Market Commentary

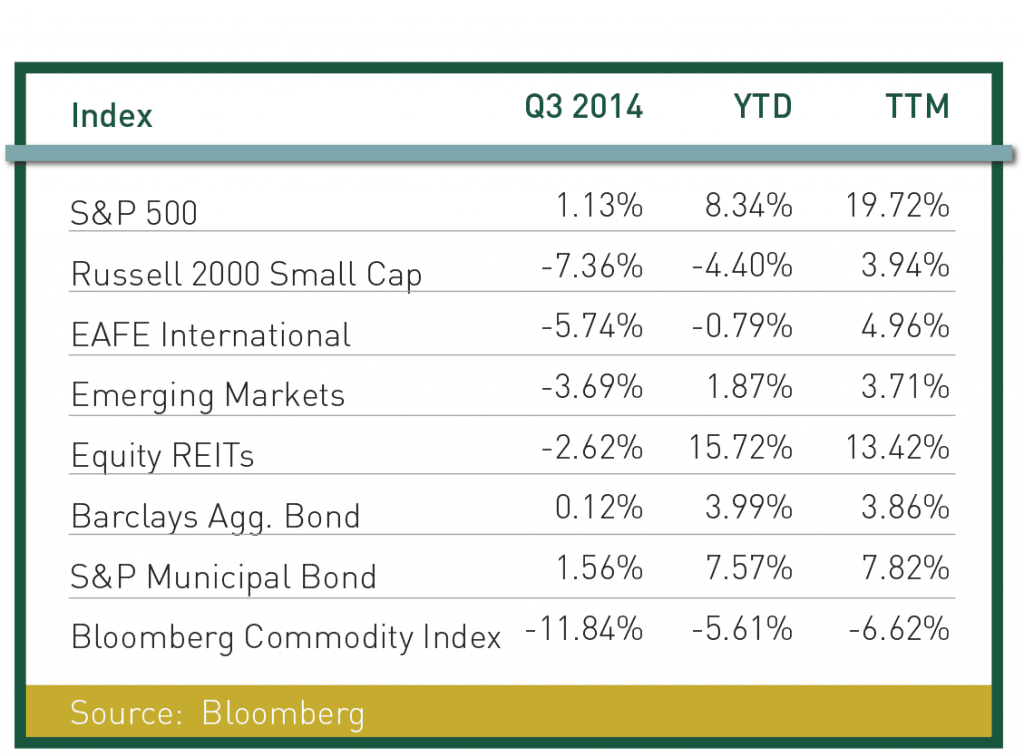

With a back drop of an increasingly solid economic landscape in the US, deflation fears in Europe, and geopolitical uncertainty in the Middle East, Ukraine and Hong Kong, it is not surprising that the third quarter was tumultuous. European equity markets, responding to slowing growth, were weak across the board. In the United States, the trend favored large cap stocks over small, Japan struggled to keep its economy growing, and emerging markets were mixed. The nearby chart shows the performance for global markets for the third quarter and year to date.

The S&P 500 hit an all-time high in September before retracing some of those gains in the final week of the quarter to end 1.1% higher on the quarter and 8.3% higher for the year to date. Despite hitting that new high, the S&P traded in a 60 point range after recovering from the late July sell off. Conversely, small cap stocks, as measured by the Russell 2000 Index, declined 7.4% in the third quarter and 4.4% for the first nine months.

Six years after the economic crisis, the US economy is starting to look more normal: in absolute numbers, the number of individuals employed has finally surpassed pre-recession levels, although the unemployment level is still 6.1%. Consumer spending is growing, home builder confidence is at its highest levels since late 2005, the small business survey continues to improve and businesses are spending on capital goods. On the heels of a very weak first quarter when US Gross Domestic Product (GDP) contracted 2.1% due to the harsh winter, second quarter GDP rebounded to grow a solid 4.6%. We believe the GDP results will be at a more normalized 3%, plus or minus, for the third quarter.

Economic growth has slowed in Europe. At the start of the year we thought Europe was poised to emerge from recession; the crisis in the Ukraine tilted the apple cart. In the second quarter, economic activity contracted in Germany (-0.6%), France (-0.1%) and Italy (-0.7%), only Spain exhibited positive growth of 2.3%. We remain cautious in committing additional dollars to Europe and Russia until the geopolitical issues are resolved.

The US bond markets have been skittish. As the economic recovery gained momentum, the Federal Reserve unwound, or tapered, the extraordinary interest rate measures they took to keep long term interest rates low. The Fed has long broadcast that the taper will be complete in October, which means that long term interest rates will be determined by market forces. To offset the impact of market driven interest rates, the Fed has also broadcast that they will keep short term interest rates low for an extended period. While inflation remains low and therefore not a rationale for the Fed to raise rates in the near term, most pundits believe that the Fed will start to raise short term rates in late 2015. As a result, we have noticed some tightening of credit, some widening of the spreads between high quality and high yield bonds and a fixed income market that reacts to any news story.

On a valuation basis, we continue to like large domestic stocks, but as we wrote in another article in this edition of the Guardian, we reduced our exposure to small cap stocks due to high valuations in that sector in the spring. With this low interest rate environment, we are looking for alternative income ideas including master limited partnerships and unique bond structures. That said, we still believe that one of the most attractive assets to generate income remains dividend paying stocks; the combination of dividend yield, dividend growth and the underlying growth of the companies provides a solid trifecta for investors looking for growth and income.

The fourth quarter is typically a positive quarter, and the S&P 500 has not declined in the 12 months following a midterm election since 1948, so despite the recent weakness in the markets, we view using any market dips as a buying opportunity.

Related Articles

July 10, 2025

Watch Coldstream’s MarketCast for Third Quarter 2025

June 24, 2025

Managing Increased Uncertainty in the Middle East

June 4, 2025

Watch Coldstream’s Q2 2025 ISG Webinar