Insights

April 13, 2015

Signals from the Noise – Market Update

In Market Commentary

I recently read a NY Times Magazine article by Clay Tarver, detailing the remarkable story of Jason Everman. Everman had the incredible distinction of being kicked out of both Nirvana and Soundgarden prior to their explosive success in the 1990s. He later, as he put it “decided to do the most un-cool thing, join the Army.” Everman persevered through training and eventually joined the Rangers and then onto Special Forces, distinguishing himself through more than a decade of hot deployments. Post Army, Everman graduated from Columbia University with a degree in philosophy. On his plans for the future “I’ll probably just be a bartender somewhere.” In a life that has played out like a Greek tragedy, Jason is still the wise student attempting to divine messages the Gods have been sending him. Noisy as those signals may be.

At Coldstream we too are students, attempting to filter the noise the market Gods generate, identify signals, and act on conviction. If the defining signal of Q4 2014 was the collapse in oil prices, where tectonic forces of new technology and geopolitics combined to cut oil prices in half, the defining signal of Q1 2015 was the rise of the U.S. Dollar. Again, tectonic forces of divergent monetary policies between the ECB (European Central Bank), BOJ (Bank of Japan), SNB (Swiss National Bank) BOE (Bank of England), and the Federal Reserve impact the direction of markets. These authorities have taken differing paths with the ECB and BOJ running quantitative easing, the Swiss de-linking their Euro peg, and the Federal Reserve and the BOE signaling higher interest rates. Money goes to where it gets the highest risk adjusted return and the market has signaled – very loudly – that the United States is that haven. While our interest rates may seem paltry, they are certainly better than the negative/low rates exhibited in Europe and Japan. That, combined with noise from the Fed signaling higher interest rates, has generated significant interest in the US dollar from global investors.

At Coldstream we too are students, attempting to filter the noise the market Gods generate, identify signals, and act on conviction. If the defining signal of Q4 2014 was the collapse in oil prices, where tectonic forces of new technology and geopolitics combined to cut oil prices in half, the defining signal of Q1 2015 was the rise of the U.S. Dollar. Again, tectonic forces of divergent monetary policies between the ECB (European Central Bank), BOJ (Bank of Japan), SNB (Swiss National Bank) BOE (Bank of England), and the Federal Reserve impact the direction of markets. These authorities have taken differing paths with the ECB and BOJ running quantitative easing, the Swiss de-linking their Euro peg, and the Federal Reserve and the BOE signaling higher interest rates. Money goes to where it gets the highest risk adjusted return and the market has signaled – very loudly – that the United States is that haven. While our interest rates may seem paltry, they are certainly better than the negative/low rates exhibited in Europe and Japan. That, combined with noise from the Fed signaling higher interest rates, has generated significant interest in the US dollar from global investors.

The US remains a stable and growing economy, strong enough to support non-emergency level Fed-funds rates. Unemployment continues to fall and inflation expectations are stabilizing. We are still constructive on the US markets, particularly Mid and Small cap stocks.

We expect European and Japanese companies will see an export boost as they benefit from a declining value of currency vis-à-vis the US dollar. We anticipate this easy monetary stimulus will inflate asset prices, and we are seeing that scenario play out in the European and Japanese markets.

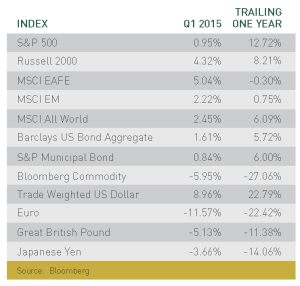

After a stunning 13% run in 2014, the S&P 500 took a pause in the first quarter. Other markets have been playing catch-up after lagging the Large Cap index for most of 2014. Not surprisingly, companies that have a smaller percent of their revenue from non-domestic sales will be less impacted by the strong dollar, and we are starting to see that differential play out in the market returns. For instance, small cap stocks, as measured by the Russell 2000 Index, increased at a good clip in the first three months of the year.

As we saw in the US, quantitative easing works initially by inflating asset prices. Since the QE programs were announced in Europe and Japan, developed international stocks have shown solid gains as measured by the MSCI EAFE Index. Another reason for the uptick is money tends to flow out of bonds and into stocks as interest rates fall below the dividend yield for equities. The dividend yield on the Developed International EAFE index stands at 3.04%; the 10 year German sovereign bond yield stands at 0.2%. As market sage Jason Trennert at Strategas likes to say in regards to equities, “This is a T.I.N.A. equity market: There Is No Alternative.”

Our economic outlook remains positive. The US economy is expected to remain strong, even though stock valuations are at new highs. The Fed continues to iterate towards a removal of ‘emergency policy rates’, meaning we may get paid on our cash starting, perhaps, in July or September of this year. Forecasting future multiple expansion is a dicey business, one predicated on animal spirits and greed/fear. We remain cautious. We believe that foreign stocks will appreciate from their relatively low current valuations to more normalized expansionary levels. This multiple expansion, on top of growing earnings, should create real opportunities for overseas investments.

We expect oil prices to remain low, a boost to consumers and consumer nations. We expect the US dollar to remain strong but we do not expect to see a continuation of the dramatic moves in the first quarter. The supply glut that precipitated the drop in oil prices is moderating as we write this article; production will likely peak in 2015. Oil continues to pile up and we expect some defaults and increased volatility in energy names as the energy industry evolves to the new global glut realities.

The market Gods continue to send us noise and signal, we will continue to interpret, and with fortune, plan accordingly.

Related Articles

July 11, 2025

The Return of Diversification

July 10, 2025

Watch Coldstream’s MarketCast for Third Quarter 2025

June 24, 2025

Managing Increased Uncertainty in the Middle East