Insights

October 18, 2021

Should I Complete the FAFSA?

In Family Needs, Wealth Strategy

Each year in October the window opens to submit the Free Application for Federal Student Aid (FAFSA) for the following school year. Although you have until June 30th to complete your application, filing your FAFSA as close to October 1st as possible can improve your chances of qualifying for the most grant, scholarship and work-study aid. Certain aid is awarded to students who apply the earliest, such as federal work-study dollars and many state and institutional grants and scholarships.

However, many high-income parents wonder if it’s worth their time to complete the FAFSA. Typically, college counselors recommend applying even if you suspect you won’t qualify, in part due to the complexity of financial aid formulas. Even if a student will not qualify for grants, filing the FAFSA makes them eligible for low-cost federal student loans, which are usually less expensive than private student loans. Even wealthy students will qualify for the unsubsidized Federal Direct Stafford Loan and the Federal Parent PLUS Loan. The Federal Stafford Loan is a good way for the student to have skin in the game. Some parents encourage their children to apply as an educational tool to learn about debt and offer to pay off student loans upon reaching certain agreed-upon milestones.

Additionally, one of the key reasons to submit the Free Application for Federal Student Aid (FAFSA) is that some colleges require this form to be on file to receive merit-based aid, which can be significant. Merit aid is a form of college financial aid that does not consider a student’s financial need, but rather is awarded based on academic, athletic, artistic or special-interest merit. You may be eligible for more aid than you realize – you don’t have to be a straight A student to be eligible for many of the special-interest scholarships.

The FAFSA process determines the Expected Family Contribution (EFC). The EFC is the minimum annual amount a college thinks you can afford to pay toward your child’s education. Let’s take a hypothetical example, with an EFC of $20,000 for a college freshman. At a public state university with costs of $25,000 per year, your child would likely receive little direct aid, and instead be offered federal loans to make up the $5,000 difference.

But at a more expensive school, you might actually be eligible for more aid that keeps the final cost within your budget. Take a hypothetical private college, with a price tag of $50,000 per year. The extra cost could be reduced by a range of additional funding sources. These include merit scholarships, need-based grants, and work/study options that could make the final cost quite competitive with that of the state university.

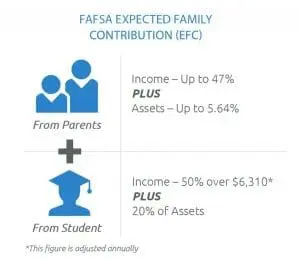

The FAFSA EFC formula includes several components: parental income and assets; student income and assets; family size; age of oldest parent; and number of family members in college. As the accompanying chart shows, parental income is assessed at a much higher rate than parental assets. So, it’s possible that adjusting your asset and income mix before applying for aid could increase your eligibility.

Assets included in EFC Calculation

- Mutual Funds, Stocks, Bonds

- Stock Options, Money Markets, CDs

- Vacation Homes

- Rental Property

- Student Owned Assets

- Trust Accounts

- Minor Accounts

- Section 529 Plans

Notably assets in a qualified retirement plan accounts, such as a 401k, Roth 401k, IRA, pension, qualified annuity, SEP, SIMPLE or Keogh Plan, are not reported as assets on the FAFSA. The value of your primary home is also not included as an asset.

Students are expected to contribute 20% of their assets—a far higher rate than the 5.64% assessment for parental assets. Student income is also assessed at a higher rate – 50%, compared with parental contributions ranging from 22% to 47%. For grandparents who save money in 529 accounts, it should be noted that withdrawals will be considered student income, which will be assessed at the higher rate. Families should consider that factor when setting up 529 accounts.

Some families may have specific circumstances that would allow one custodial parent to receive better aid packages than the other. Divorced couples, single parent families, or families with multiple children in college might receive more aid.

The aid process includes many variables, some of which may create conflicts with traditional financial objectives. For example, federal and state tax payments reduce a family’s EFC. But as you know, financial planners often aim to reduce tax payments. It might be worth taking a fresh look at your tax planning options.

Sound confusing? Well, it can be. That’s why we recommend beginning to plan for college as early as possible. Your Coldstream advisory team can help you get started. For some families, it might also make sense to check with a college planning expert, and we’d be happy to recommend one. You can also find more information at https://fafsa.ed.gov/.

Thank you to college financial planning specialist, Peg Keough, for contributing to this article.

Related Articles

June 27, 2025

Diversified Estate Planning for LGBTQ+ Families

June 20, 2025

Incorporating a “Die with Zero” Philosophy into Your Long-Term Financial Plan

June 9, 2025

Helping children build wealth of their own: why the Roth IRA is an important gifting vehicle.