Insights

April 14, 2014

Polar Vortex : A Freeze on the Bull Market?

In Market Commentary

“As a newsman, I want to salute whoever came up with the term ‘polar vortex,’. It is terrifying but still sounds all science-y. A lesser meteorologist could have overreached with ‘arctic coldnado’ – Stephen Colbert 1/06/14

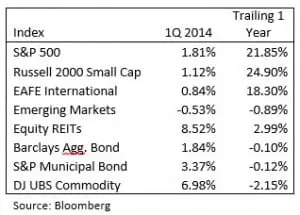

Hyperbole aside, while the polar vortex of freezing temperatures may have frozen most of the US, it had only a minor effect on market and broader economic activity in Q1. After a very hot year in the markets in 2013 it is reasonable to expect a cooling-off period. In our last quarterly update our Chief Investment Officer, Bob Frazier, forecasted a 5-10% correction in the S&P 500 – he was spot on. Over the first few weeks of 2014 the S&P 500 dropped 6% before recovering to close the quarter at new highs. Some of 2013’s biggest losers rebounded strongly in the first quarter; municipal bonds rallied 3.37% on lower interest rates and a calming of nerves following Detroit’s bankruptcy last year. Commodities also staged a rally of nearly 7% after a tough year in 2013. International markets were roiled when Russia annexed Crimea and the threat of a trade war loomed. That crisis has ebbed but is not over; cooler heads appear to be prevailing for the time being, but that can change at any moment. Asian emerging markets were soft on continued fear of a Chinese debt bubble bursting with an attendant hard landing.

new highs. Some of 2013’s biggest losers rebounded strongly in the first quarter; municipal bonds rallied 3.37% on lower interest rates and a calming of nerves following Detroit’s bankruptcy last year. Commodities also staged a rally of nearly 7% after a tough year in 2013. International markets were roiled when Russia annexed Crimea and the threat of a trade war loomed. That crisis has ebbed but is not over; cooler heads appear to be prevailing for the time being, but that can change at any moment. Asian emerging markets were soft on continued fear of a Chinese debt bubble bursting with an attendant hard landing.

Despite record low temperatures across much of the eastern United States the economic data continued to come in strong in Q1 2014. Unemployment continued at a 6.7% rate, just a shade over the official 6.5% target of monetary authorities. Inflation remained very low with a trailing 1 year CPI of 1.1%, and 1.6% excluding food and energy. Low inflation is driven primarily by lower energy prices, a result of the shale oil and natural gas boom. The minutes from recent Federal Reserve meetings indicate that the governors anticipate ending quantitative easing in 2014 and increasing short-term rates in the latter half of 2015, on the back of improving fundamentals in the US economy.

Our base-case global forecast for 2014 remains the same. We expect stocks will continue to grind higher, with European stocks taking the lead, while interest rates also move up modestly with the taper of Quantitative Easing and in anticipation of rising short-term rates. Absent an invasion of Eastern Europe by Russia or deepening trade war, we feel Europe should continue its climb out of recession. Two years of austerity and labor market reform by governments across Europe have set the stage for natural expansion across the Euro Zone. We expect European stocks to begin outperforming their domestic counterparts, as valuations revert to parity with the US and economic momentum swings. We feel investors are cautiously awaiting the effects of Japan’s increased consumption taxes. If Japanese consumers maintain or increase their spending we could see renewed positive action in Japanese stocks, whose valuations remain tame despite last year’s big climb. Emerging markets are still a question mark. Valuations are at record lows for the index, but investor sentiment is very negative and outflows continue to be significant. We expect emerging market stocks to begin improving later this year as fears about the magnitude of the Chinese slowdown abate. We also expect greater return dispersion within emerging markets, the result of drastically different economic policies and trade balances between developing nations. The outlook for commodities remains in question, China’s outlook being the dominant factor. Our best estimate is that Chinese authorities will be able to manage the slowdown with the policy tools at their disposal: managing the currency exchange rate, their pile of foreign currency reserves, and the authority to punish many bad investments and investors, while propping up others.

Related Articles

June 24, 2025

Managing Increased Uncertainty in the Middle East

June 4, 2025

Watch Coldstream’s Q2 2025 ISG Webinar

April 14, 2025

Watch Coldstream’s MarketCast for Second Quarter 2025