Insights

March 5, 2025

Navigating Uncertain Times

In Investments, Market Commentary

As we navigate the opening months of 2025, the Trump Administration’s policy agenda is once again making headlines, with a focus on deregulation, immigration, government reform, and most notably through the recent introduction of tariffs on imports from key trading partners such as Canada, Mexico, and China. These shifts are understandably stirring some uncertainty, as their effects ripple across markets, driving volatility and prompting questions about the future. At Coldstream, we are dedicated to helping you weather these changes with clear-eyed perspective and strategic, forward-thinking planning.

Uncertainty is not new to investing — it is a constant companion to the pursuit of capturing long-term investment returns. While short-term fluctuations can feel unsettling, they don’t necessarily derail long-term growth. What we are seeing now, with tariffs and shifting trade dynamics, is a chapter that echoes past periods of disruption. History shows us that markets tend to adapt, even amidst bold policy shifts. For example, during Trump’s first term, tariff announcements initially rattled stocks, but the broader market regained footing as clarity emerged and businesses adjusted. Today, while the specifics differ, the principle holds: short-term turbulence doesn’t dictate long-term outcomes. Our focus remains on the bigger picture — your goals, your timeline, and the resilience of your portfolio.

Market Reaction

That said, we are not ignoring the present. The tariffs which took effect on March 4, 2025, are driving some immediate market reactions: stocks and bond yields have dipped, and analysts are debating the inflationary impact. On March 3rd, the S&P 500® experienced its sharpest daily drop since December 18th, sliding 1.8% as news of 25% tariffs on Canada and Mexico was confirmed —following its slight reprieve from the initial announcement of tariffs on February 1, 2025.

But as long-term investors, let’s zoom out for a broader view. Up until the beginning of March, market volatility has actually been surprisingly subdued in 2025. Despite the bold rhetoric and policy proposals following President Trump’s inauguration in January, the S&P 500® has largely held firm, buoyed by solid corporate earnings and a resilient U.S. economy. In fact, even after the March 3 decline, the S&P 500 Index sits only marginally below its all-time highs, approximately 5% off the peak it hit late last month. To give you a sense of how calm things have been until recently, the CBOE Volatility Index (often called Wall Street’s “fear gauge”) hovered at unusually low levels for much of the year, reflecting a market that, until now, has taken much of this uncertainty in stride.

Historical Context

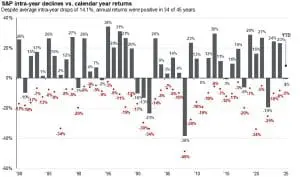

What does this mean to you? Volatility spikes like we have seen this week are not uncommon when bold policy changes dominate the news cycle. Think back to the trade tensions of 2018-2019 during Trump’s first term, for example. Yet history also shows that markets tend to adapt over time. While tariffs could pressure short-term growth or push inflation higher, potentially affecting Federal Reserve rate decisions, the underlying strength of the U.S. economy, supported by consumer spending and corporate profitability, remains a key driver. The S&P 500®’s resilience, even after the sell-off this week, underscores that point. The S&P 500 Index is still essentially flat on year-to-date basis following two consecutive years of over 20% gains (refer to the following chart).

*Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. For period ended March 3, 2025.

Coldstream’s Investment Strategy Group (ISG) is closely monitoring the ripple effects of these policies, in particular watching to see whether tariffs stick, get scaled back, or spark retaliation, and ultimately what that means for sectors and asset classes. For now, the data and history suggest this may be more of a ripple than a tidal wave and part of President Trump’s “The Art of the Deal” negotiating tactics.

Coldstream’s Strategy

Coldstream is here to adjust as needed while keeping perspective on the bigger picture. A well-diversified portfolio is designed to weather these kinds of storms by balancing risk and opportunity across asset classes and investment strategies. Your portfolio was built with this kind of resilience in mind. By staying diversified across asset classes, sectors, and geographies, we have positioned you to weather storms like these without losing sight of your long-term goals.

What’s key here is maintaining a disciplined approach. Headlines can amplify fear, but reacting impulsively often undermines the pursuit of long-term objectives. We have positioned your investments to withstand uncertainty rather than just chasing today’s news. And while Trump’s policies are aggressive, they are also fluid. Negotiations or adjustments could temper their bite over time, as we’ve seen before. Our strategy is to remain proactive, not reactive, ensuring your plan stays aligned with your long-term vision.

If you are feeling uneasy or have specific questions about how these developments might affect you, please do not hesitate to reach out to your Wealth Manager. Whether it’s a quick call to talk through your concerns or a deeper review of your plan and portfolio, Coldstream is here to provide clarity to the best extent that we can but more importantly, confidence in the roadmap to your ultimate goals and objectives. We have navigated uncertain times before, and Coldstream is committed to guiding you through this one with the same care, discipline, and expertise.

Thank you for your trust in us. Together, we will keep navigating these waters with a steady hand.

* The CFA Institute owns the certification marks CFA® and Chartered Financial Analyst®. CAIA® is a registered certification mark owned and administered by the Chartered Alternative Investment Analyst Association® in the United States.

Related Articles

June 24, 2025

Managing Increased Uncertainty in the Middle East

June 4, 2025

Watch Coldstream’s Q2 2025 ISG Webinar

May 12, 2025

Why people make irrational financial decisions