Insights

July 30, 2014

A Green Light for Further Gains?

In Market Commentary

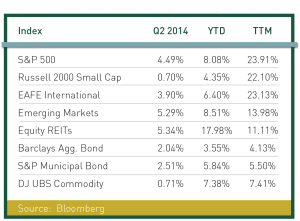

The first half of 2014 turned out to be positive almost everywhere you looked in the financial markets. After posting a stellar 2013, the bull market and asset inflation have continued. While back to back large double digit annual returns from stocks do not happen often, it is normal to see a positive return in the S&P 500® Index the year following one like 2013. We estimate if the economy can sustain current growth levels, high single digit returns from the stock market this year seem reasonable, and so far that forecast is playing out well. We are of the mind that over the longer term, five to ten years out, we are in a secular bull market for stocks and the economy. We also note the improvement of International Developed markets relative to the US. As you can see from the data below, International markets are performing at par with the US this year, a welcome development for longer term global growth. That said, we are always reminding ourselves that 5 to 15% corrections are commonplace in bull markets.

US employment is one of the key economic variables the Federal Reserve is watching to determine interest rate policy. On July 9th, ADP’s National Employment Report showed private payrolls added 281,000 jobs in June, the most since November 2012. The report showed that manufacturers, builders and other goods-producing industries increased headcount by 51,000. The Bureau of Labor Statistics jobs numbers followed suit as Nonfarm Payrolls increased by 288,000 workers in June following a 244,000 gain the month prior. The increase in employment of 1.39 million over the past six months is the biggest gain over a similar period since early 2006. The Unemployment Rate decreased to 6.1% from 6.3% in May, which put the jobless rate at the lowest level since September 2008. The median duration of the unemployed fell to 13.1 weeks down from 14.6 weeks in May, the lowest in 5 years. The Labor Force Participation Rate was unchanged in May at 62.8%, and is down by 0.6% during the past year. Clearly, the employment situation in the US is still not robust, but recent numbers point to a potential acceleration to the upside that is much needed for the current economic recovery to continue. The Fed has indicated that based on current trends interest rates should begin to rise in late 2015.

US employment is one of the key economic variables the Federal Reserve is watching to determine interest rate policy. On July 9th, ADP’s National Employment Report showed private payrolls added 281,000 jobs in June, the most since November 2012. The report showed that manufacturers, builders and other goods-producing industries increased headcount by 51,000. The Bureau of Labor Statistics jobs numbers followed suit as Nonfarm Payrolls increased by 288,000 workers in June following a 244,000 gain the month prior. The increase in employment of 1.39 million over the past six months is the biggest gain over a similar period since early 2006. The Unemployment Rate decreased to 6.1% from 6.3% in May, which put the jobless rate at the lowest level since September 2008. The median duration of the unemployed fell to 13.1 weeks down from 14.6 weeks in May, the lowest in 5 years. The Labor Force Participation Rate was unchanged in May at 62.8%, and is down by 0.6% during the past year. Clearly, the employment situation in the US is still not robust, but recent numbers point to a potential acceleration to the upside that is much needed for the current economic recovery to continue. The Fed has indicated that based on current trends interest rates should begin to rise in late 2015.

The real estate recovery is another key economic variable for the Federal Reserve. The National Association of REALTORS® (NAR) Index, tracking pending sales of existing homes, rose a seasonally-adjusted 6.1% in May. It was the largest monthly gain for the Index since April 2010 when home sales spiked 9.6% ahead of the expiration of first time home buyer tax credits. Pending home sales also climbed in all regions of the country. The Mortgage Bankers Association Application Index fell 0.2% in the week ended June 27th after falling 1.0% in the prior week. Refinances increased 0.1% after decreasing 1% in the prior week; new purchase applications fell both weeks. The average rate on a 30-yr Fixed-Rate Mortgage fell to 4.28% from last week’s 4.33%, while 15-yr fixed rates are 3.47%. Interest rates remain at historically low levels and continue to fuel a modest recovery in the housing sector.

In summary, 2014 is off to a great start with optimism the last half of the year we will continue to see economic activity and earnings growth accelerate, with further gains in employment. The recovery that began in mid-2009 appears to be on track with easy monetary policy, low inflation, and overall global economic growth. Geopolitical risks exist in every market, but barring some unforeseen shock to the economy or world stage, the next catalyst for a re-pricing of assets will most likely occur as the Federal Reserve moves to a more hawkish monetary policy.

Rising interest rates have historically not been bullish for stocks, although not immediately; it is the longer term compounding effect of a series of higher rates that is the catalyst for a market correction. If, as we anticipate, interest rates do not rise until late 2015 we believe it will be well into 2016 until interest rates begin to affect stock prices to the downside. In the meantime, the Fed has indicated they are watching both the labor markets and inflation to guide their monetary policy. For now, to us that is a green light for further gains in client portfolios!

Related Articles

July 11, 2025

The Return of Diversification

July 10, 2025

Watch Coldstream’s MarketCast for Third Quarter 2025

June 24, 2025

Managing Increased Uncertainty in the Middle East